By Ron

Jackson

Editor/Publisher

The

domain business was just starting to climb out of a severe slump

in the fall of 2003 when DNJournal.com began publishing

weekly reports on domain sales. As the market heated up in 2004 and

prices began an upward trajectory, we started getting complaints

that our focus on the biggest sales was causing prices to go higher,

making domains more expensive to acquire than they would be

otherwise. The common objection was that the large sales we featured

were anomalies that made sellers think their domains were worth more

than they really were.

|

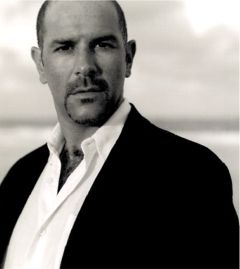

Internet

Real Estate Group, LLC Partners

(Left to right): Andrew

Miller, Mike

"Zappy" Zapolin

and Peter

Hubshman

|

|

About

this time last year, just as the criticism was reaching a crescendo,

I got a call from Andrew Miller, the President and Co-Founder

of the Internet Real Estate Group, LLC (recent

name change from Deal Jam,

LLC) in Boston. Andrew had a complaint too, but his was

one I had not heard before. Miller said the publicly reported sales

we featured showed prices that were much lower than

what premium properties were actually trading for, giving buyers the

mistaken impression that good domains were cheap!

Miller

filled me in on what was happening at the real high end of

the market where prices paid are rarely disclosed. What we show you

each week are sales that have been made public, essentially the tip

of the iceberg. No one really knows how big the whole iceberg

is, but Miller left little doubt in my mind that his view from the

top was more accurate than the one I was hearing from so many people

operating at ground level.

Miller

was the ultimate man in a position to know. It was his company

that sold CreditCards.com for $2.75 million (the

highest publicly reported sale of 2004). Ironically, that not only

was not the highest sale industry-wide last year, it wasn't even

the highest sale at his company! Miller told us, "I have always

said to anyone who cares to listen, the largest domain name sales

are the private ones, which are almost always under strict

non-disclosure agreements (NDA). Most buyers would prefer to

acquire the asset and not disclose the price they paid and we have

made it a key point to develop the trust and respect of those types

of buyers and partners."

Sales

made by the Internet Real Estate Group (or current partners prior to

the company's incorporation) have included some of the biggest

blockbusters in industry history. Here is just a sampling, some of

them with prices that have been cleared for release for the first

time:

-

Beer.com

- Sold to Interbrew for $7

million

-

Shop.com

- Sold to Altura International, a Bill Gates/Amazon.com

backed private company, in November 2003 for $3.5

million.

-

Diamond.com

- Sold to Odimo (NASDAQ ODMO), a partnership

between Steinmetz Group (the 2nd largest raw diamond

company in the world) and Softbank in 2000 for $6

million.

-

Telephone.com

- Sold to a private equity group in 2000 for $2

million cash plus equity.

-

Computer.com

- Sold to Office Depot in 2001 (price subject to NDA)

-

College.com

- Sold to private buyer in December 2003 (price subject to NDA)

-

Timeshares.com

- Sold in October 2004 to Cendant (price subject to NDA)

With

spectacular sales like those under their belts, you might be

surprised to learn that Miller and company are taking a different

approach now. Don't expect a lot of sales from them in the near

future. "Today we are buyers, Period!," Miller declared.

"We believe that we are still in the Wild Wild West of Internet

Real Estate and the values should increase significantly for

prime generic domain properties."

While

Miller and his founding partner, Internet Real Estate Group CEO

Peter Hubshman, have been a force in the domain industry for

several years, to quote Bachman-Turner Overdrive "you

ain't seen nothin' yet". A dynamic third partner, Miller's

long-time friend Mike "Zappy" Zapolin has joined the team,

creating a triumvirate with credentials that are unsurpassed in this

business. Andrew and Mike are both Harvard Business School graduates

and Peter has a Masters Degree in management from Yale. Their

professional successes could fill a book. We'll

cover some of their

career highlights, but the best place to start is always the

beginning.

|

Andrew

Miller was born in Boston, the oldest of three brothers who

grew up just outside the city in Wellesley, about half

mile from Wellesley College (one of America's most

famous women's colleges). Andy's dad was a management side

labor attorney with a very successful firm of his own that

enabled him to provide his family with all of the material

things they needed or wanted. However he couldn't buy the one

thing he wanted most, even though he would have given his last

cent to have it. That was good health for his two youngest

sons. Both of Andrew's brothers suffered from a rare illness

called Glycogen Storage Disease (GSD). In fact they

were among the first children ever diagnosed with the disease

and were pioneers in developing treatments. The youngest son, Greg, died in 2002 from

cancer that may have been triggered by the

underlying illness. Scott Miller is still battling the

disease but is holding his own well and is an integral

part of the team at Internet Real Estate Group.

|

Andrew Miller |

Money

and health can be ephemeral things, so the elder Miller taught his

sons to value things that would last. "I learned the importance of

hard work, discipline, honesty, and maintaining high values and

integrity," Andrew Miller said. "My dad always says that at the

end of the day all you have is your reputation." Miller learned

an equally important lesson from his mother that has served him well

throughout his life. "My Mom has more tolerance than most

people I know and only sees the good in everybody." Sharing

that outlook has made it easier to build relationships and great

relationships are the foundation Miller's enterprises have always

been built on. He is passing those values down to the son and

daughter he and his wife are raising today.

Miller

paid attention to his studies at Belmont Hill School and

earned a place in the Ivy League at Cornell University

(today a good chunk of his time is spent on fund raising activities

for Cornell, GSD and cancer related causes). In 1988, after

graduating from Cornell, Miller was accepted into Drexel Burnham

Lambert's renowned IST (Intensive Sales Training) program

at company headquarters in New York. The concept was to take

20 young people each year (selected from a group of over 1000),

train them for 18 months with time spent in every department of

Drexel, with a goal of placing each of them in Drexel offices as

liaisons to the senior deal makers and traders at the firm.

As

Miller headed into his second year in the Drexel program a new class

came in that included a Boston University graduate named Mike

Zapolin, a kid who was voted Male Class Clown at Lexington

High School in Massachusetts. The Female Class Clown

winner, Rachel Dratch, made a career out of being funny. She

is now part of the cast on NBC-TV's Saturday Night Live.

Miller and Zapolin hit it off right away. �"We were both from the

Boston area - an immediate bond - and we liked to gamble, eat

Chinese Food, and shared many a drive that year home to Boston,"

Miller recalled. "Sometimes one just meets a friend that they know

is a special bond. That is about the best way to describe it."

While

Miller's class was able to finish the Drexel program, Zapolin's was unfortunately disrupted when U.S. Attorney Rudolph

Giuliani (later Mayor of New York) indicted "junk bond king"

Michael Milken for alleged security violations and closed the

firm overnight. Still, Zapolin soon found a new home at investment

bank Bear Stearns where at age 24 he became one of the

youngest Vice Presidents in the 100 year history of the company.

|

Mike "Zappy" Zapolin |

Zapolin

was also an early pioneer in the infomercial business and was

interviewed by Katie Couric on the Today

show. At the end of his segment he gave out the company phone

number, generating calls from future direct marketing clients

including Diana Ross and Time Warner. He has

been featured on all of the major TV networks as well as

newspapers and magazines like Business Week, the Wall

Street Journal, New York Times and USA Today.

In

1994, Zapolin began to investigate Kabala

and has traveled extensively to study with many of the World

Masters. He has co-written (with Deepak Chopra) Ask

the Kabala, an interactive Kabala beginners kit due

out next year from publisher Hay House. Zapolin credits

some of the basic principles of Kabala as being factors in how

he evaluates, selects and develops internet real estate. |

Their

business careers eventually brought Miller and Zapolin back

home to Boston where legendary rock band The Grateful Dead

had a hand in launching them to still another success. Miller told

us, "we dreamed up our various entrepreneurial ventures while

following the Grateful Dead around the country, finally creating a

direct marketing television show for the Dead, which lead to us

becoming Executive Producers of a very successful VH1

merchandising show for the band, hosted by NBA Hall of Famer (and

noted Dead Head) Bill Walton. While we both had

successful investment businesses, I believe we both had greater

goals. We both shared the desire to be the client whose money was

managed and not the investment advisor. We both had the balls to

walk away from our early financial success to make it happen."

"We

have started a business together (Marketvision Direct, Inc.),

partnered on several domain successes (Beer.com, Diamond.com, CreditCards.com

and Shop.com) and became alumni of Harvard Business School

together via our graduation in 2004 from the college�s prestigious

Owner President Management program. For the last 2 years

Zappy has taught the eBusiness elective which he developed

for Harvard Business School's Executive program. Now we are

excited about joining forces to take Internet Real Estate Group to

the next level!" Miller said.

Zapolin

certainly brings some unique qualities to the partnership. In 2000

he starred in his own Super Bowl ad for Computer.com.

The award winning ad ran during the final minute of the St. Louis

Rams-Tennessee Titans cliffhanger and according to ABC

was one of the highest rated commercials of all time. Last year he

successfully negotiated the acquisition of Music.com (which

he co-founded), currently being developed in Los Angeles by music

industry insiders.

With

Asia emerging as a world business superpower, Zapolin is also

well equipped to help there. He has traveled to Japan to

consult for Akio Toyota and recently was a speaker at the Economist

Magazine's "Branding Conference" in Shanghai.

Domainers will get a chance to hear both Zapolin and Miller talk

next month as they will be the co-keynote speakers at the T.R.A.F.F.I.C.

East conference October 18-22 in Delray Beach,

Florida.

| Miller,

Zapolin and Hubshman are now making an even more indelible

mark with the Internet Real Estate Group which Miller and

Hubshman founded in the spring of 2001 (originally named Deal

Jam, LLC). They had been together in a previous venture,

Marketvision Direct, which they sold in 1998. They stayed on

as officers to help do a public offering before finally

leaving in December 2000. Hubshman, who has a degree in

economics from Boston's Tufts University in addition to

his Masters from Yale, has over 20 years of high level business management and investment experience. |

Peter Hubshman |

He

began his career in the early 80's as an Assistant Vice President

for Diversified Media, Inc. where he was responsible for the

successful turn around and sale of the company's New York based

Spanish language daily newspaper, El Diario La Prensa.

Hubshman's next success came in the real estate and aerospace

manufacturing divisions of DC Trading and Development where

he became Executive Vice President and a member of the Board of

Directors.

He

was one of the key founders of a successful New York based leveraged

buyout fund, First Atlantic Capital, Ltd. and also spent

several years as a finance and management consultant with R.F.

Webb Corporation and International Capital Strategies, LLC,

where he had direct responsibility for projects in the

transportation, energy, biotechnology, medical device, food

processing, market research, software, multi-media, finance, and

telecommunications sectors. With Internet Real Estate Group having

an interest in so many different product categories, Hubshman's

diverse experience has made him an invaluable asset to the team.

In

fact Milller said Hubshman is the guy who makes sure the company's engine

keeps purring. "He DRIVES the operations, site

performance, engineering management, and has overseen the building

of the entire blueprint we follow to make our properties so

successful", Miller said.

When

Miller and Hubshman collaborated on the founding of Deal Jam, they knew exactly where they wanted to go.

"Deal

Jam's plan was to acquire single word generic domain names and

build successful websites on these addresses, maintaining

operational control," Miller said. "Previously at Marketvision,

we did the same thing but instead of operating the properties

ourselves, we did deals with outside operating groups or did a lot

of outsourcing. When we formed Deal Jam, we decided to do it all

internally and own the platforms and the technology as well as the

domain name assets. The plan has clearly evolved and expanded,

especially as we created the term Internet Real Estate and began to

see that the prime generic domain names were equivalent to prime

real world real estate, just incredible addresses on which to build

a business and rapidly inclining asset values as well."

The

partners have an "A" list of corporate contacts from their time

in the investment business. They are welcomed in major corporate

suites that many competitors will only see looking up from street

level. With that status, they have become the domain industry's

most important ambassadors to corporate America. "We have spent

several years educating business leaders on the importance of

incorporating the Internet into their existing business," Miller

said. "Our success has been accelerated by outside validation as

some of the most successful dotcoms have been built on generic

domain name platforms. Many Fortune 500 companies have

acquired their category domains including Shopping.com,

Hotels.com, Rent.com, Baby.com, and others."

Getting

corporations to realize that owning the name of the category they

operate in is just as important as owning their individual brand

name has been one of the group�s most important accomplishments.

"Branding has changed in the last few years as businesses have

incorporated the web into their operations," Miller said.

"It is

not enough just to have brand recall, it is equally as important to

be present in the moment that the person is proactively searching

for what they want on the web, and the credibility to warrant their

trusting you with vital personal information. We believe in owning

that moment prior to their having made a brand preference

choice. There are only a few prime generic domain names for each

industry or category. However, nothing is easy and the caveat here

is, it is critical to know how to build, validate, educate, and

communicate those values."

"We

have been successful due to hard work, tremendous investment

backers, and by surrounding ourselves with dedicated, smart

believers. We have also spent this time developing our own in-house

expertise for buying, developing, Search Engine Optimizing,

partnering and selling "prime" Internet Real Estate which we are

now able to execute in a "cookie cutter" manner. In addition,

via our promotional sales group, we have undertaken some ancillary

efforts, such as selling corporate promotions, in an effort to build

both a database and strong interpersonal relationships with

Fortune 500 senior management teams. This has been a smashing

success," Miller added.

The

Internet Real Estate Group is well aware of the explosion in domain

interest over the past year when corporations and venture

capitalists entered the space buying up portfolios and entire

companies in a rush to secure domain assets. "There is suddenly a

tremendous amount of activity and institutional money in the

aggregating of large portfolios of domain names, most which are not

prime properties in nature," Miller said. "That is a traffic

aggregation game, a strategy to capitalize on CPC/PPC.

However, our plan is different, we will continue to be the one

and only resorts as compared to say, Marriott. We will

continue to acquire and develop properties that are the most prime

of Internet Real Estate, single word and category specific generic

domain names. We see the most value, the home runs, in owning and

developing the world's most valuable addresses or

properties," Miller concluded.

The

company's holdings back up what Miller said. They currently own such

gems as Chocolate.com, Podcast.com, Podcasting.com,

Relationship.com, Safety.com and Carbs.com.

They also retain an equity position in Shop.com and have

options on, or brokerage deals for Chocolates.com, Sponsorships.com,

Jeans.com, Privacy.com and Wireless.com. Miller said some major new

acquisitions will be announced soon as well.

A

mutual interest in gambling was one of the things that brought

Miller and Zapolin together over 15 years ago. Today, with

everything they have going for them, the Internet Real Estate Group

may be the best bet they�ll ever make.

***** Copyright

2005 - Domain Name Journal - An Internet Edge, Inc. company

All

DNJournal Cover Stories

are available in our Archive

Return

to Domain Name Journal Home Page

|