|

Thought

Convergence Selling Off Their

Top Tier .Com Domains in NameJet/SnapNames

Auctions

|

|

Over

800 domains

from one of the industry's best

portfolios of premium domain names

are going up for sale in a series

of auctions on Newfold

Digital's NameJet

and SnapNames platforms.

The landmark sale is the result of

a decision by Thought

Convergence

co-founders Ammar Kubba and

Kevin Vo to liquidate the

remaining assets of their holding

company and distribute

the proceeds to their

shareholders.

The

term "premium" tends to

get over-used when it comes to

domains, but in this case the term

is a perfect fit for the

collection that includes

Beer.com (part of a fabulous

lot of 27 domains that includes

"beer" in other popular

languages around the world,

including Cervezas.com

(Spanish), Biere.com (French),

Beoir.com (Irish), and many

more).

Then there is AKA.com, NonStop.com,

Aftermarket.com, Trainer.com,

Illustrate.com, HelpLine.com

and hundreds more. Most of the

auction lots are being offered with

a low or no reserve.

You

can place pre-release backorders

on the various domains before

their specified deadlines (those

are staggered across three nights

beginning Friday night,

December 3). The live

auctions will follow once the

backorder period closes. You can

view the domains on either NameJet

or SnapNames using the

following links:

|

|

|

Beer

Portfiolio: NameJet

~ SnapNames

/ Individual

Domains: NameJet

~ SnapNames

The

liquidation of the Thought Convergence

portfolio does not mean that veteran

domain investor/entrepreneur Ammar

Kubba is exiting the domain space.

Far from it. Earlier today, Ammar told DomainInvesting.com's

Elliot Silver, "My company, afterTHOUGHT,

Inc., still owns thousands

of domain names, and we continue to

invest and acquire on a regular basis.

Without a doubt, I’m incredibly

bullish on domain names and other

emerging digital asset classes (cryptocurrencies,

NFT’s, etc.)."

|

|

(Posted

November 30, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211130.htm

*****

|

America

is celebrating its Thanksgiving Day

holiday today. At DN Journal we

are especially thankful for all

of our readers around the world.

Many of you have been regularly visiting

us online for almost 20 years now (January

1 will be our 19th anniversary)! While our

daily interaction has mostly been in the

virtual world, we also loved spending time

face to face with thousands of friends

across the globe until the pandemic halted

in-person conferences. While Covid

continues to cause problems for many,

this too shall pass and we will be on

the go again. In the meantime, we are

wishing you all happiness and good

health and and can't wait to see as

many of you as possible in person again

soon!

Image

from Bigstock

(Posted

November 25, 2021)

|

$400,000

sale of Overview.com Gives Braden

Pollock Another Good Reason to

Give Thanks Thursday

|

|

Looks

like

we have another

interesting bi-weekly domain

sales report shaping

up this week. I just got a note

from veteran investor/entrepreneur

Braden Pollock at LegalBrandMarketing.com,

letting me know that he has sold Overview.com

for $400,000. We will be

charting the sale when our next

report comes out Friday

evening, November 26. The

report normally comes out every

other Wednesday but one of

our primary sales data suppliers

let us know there will be a short

delay in sending out thieir data

this week. That, coupled with

Thursday being America's national Thanksgiving

Day holiday, will push

publication of the new report back

two days to Friday evening.

In

addition to going on the next

all extension Top 20 Sales Chart

(at or near the top), Braden's

Overview.com

sale will be added to our YTD

Top100 Sales Chart

where it will rank among the upper

third on the elite list.

|

Braden

Pollock

LegalBrandMarketing.com

|

|

(Posted

November 23, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211123.htm

*****

|

|

NameCheap

Launches New Domain Market With

Buy It Now and Auction Options

|

|

Namecheap, the world’s second-largest domain registrar and one of the fastest-growing companies in the space,

officially announced the launch of

an all-new domain market

this morning.

The Namecheap Market,

developed

by the

company's

|

|

|

technology

team, gives buyers a state of the

art platform to quickly search, find, and purchase high-value domain names via

in-house auctions or Buy it

Now listings.

|

|

The

NameCheap announcement said the new market is designed for entrepreneurs looking for the perfect domain name for a startup or new project or

domain investors striving to expand their portfolio, noting " The new marketplace is the ideal destination for discovering untapped, unique, clever,

brandable, and memorable domain names."

|

After

being quietly launched in beta a few weeks ago, the Namecheap Market is now available to everyone and currently features more than

300,000 domain auctions, as well as millions of Buy It Now

listings.

NameCheap

CEO Richard Kirkendall said, “When I started Namecheap way back in 2000, I truly believed that domain names were the digital real estate of the future, and I wanted to make the process of finding and buying them accessible and simple for

everyone. Now more than two decades later, many domain names have indeed become

valuable digital assets, and we are once again making the process of buying and selling those assets a seamless and easy process with the new Namecheap Market.”

With more than 20 years of highly rated customer service and 14 million domains currently under management, Namecheap

has continued to increase its market share in the growing domain

industry and the new market is likely to accelerate that trend. |

NameCheap

CEO Richard Kirkendall |

|

|

(Posted

November 12, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211112.htm

*****

|

|

Why

New High End Domain Marketplace

Graen.com is Making Privacy Its

Top Priority

|

|

If

you have been following

our bi-weekly domain

sales reports over the

past couple of years, you are very

familiar with the extraordinary

boom we have seen in

aftermarket sales. The surge has been

accompanied by the emergence of

several new sales platforms and

services that see a huge

opportunity in bringing buyers and

sellers together in new ways that

will cut their expenses, speed up

transactions and provide solutions

to problems they may have had with

previous options they have

tried.

DAN.com

has been the most visible newcomer

in the space, having rolled out an

ambitious platform designed from

the ground up to appeal to the

widest possible audience. However,

there are also some new operations

that put stock in the old axiom

that says there are riches in

niches. Recently launched

aftermarket sales platform Graen.com

may

be a textbook case of

that. Graen founder Neil

Bostick is

laser-focused on the high end of

the aftermarket and he believes

he

has the solution buyers and

sellers at that level are looking

for.

|

Image

from Bigstock

|

|

Neil

Bostick

Founder, Graen.com |

Bostick

told us, "I’ve

been a buyer, seller, & broker in the domain market since 2014 and

I’ve done millions in deals since then. Since the beginning, my

focus has always been on private deals (not disclosing prices) as

I work extensively in the high value investor space (where

confidentiality makes or breaks investments). A lot of my business has

been selling super premium domains to top investors reselling

2-letter, 3-letter, & 1-word .COMs to end users, so by

differentiating through private deals I’ve kept a low profile in

the interest of the buyers & sellers I work with. Graen.com

was formed as a higher technology alternative to what I do at my

brokerage, QEIP.com, that

specialize in the same types of domains that Graen.com does - 3-letter

.COMs and better. For more background on my brokerage business, see qeip.com/testimonials

for a small list of past clients and deals I’ve executed."

That's

the high altitude overview of where Bostick and Graen are coming from,

but the nuts and bolts of how the new platform can stand out among so

many well established options is |

|

where

the rubber will meet the road. "I

agree," Bostick said, adding ,"there are way too many domain

marketplaces currently, so it’s valid to ask me ‘Why in the heck

would I start another one?!’ My answer is that out of the

50-100 marketplaces that exist, none of them do the single thing that

I (and most other high value domain investors), want them to do: be

private & not disclose sale or offer prices. In this, most

marketplaces and brokers disclose offer prices and make sales public

(for their own marketing value) and it is often at the detriment of

the buyers and sellers that trust them to represent them. In this, if

you are a seller offering a 3 letter .COM domain for a good deal on a

marketplace, broker, etcetera, and it doesn’t end up selling, the

offer price is still public and is liable to used against the seller

when a future buyer comes along." |

As

an example, Bostick said, "A

future buyer may say that you had ???.com priced at 50k two years ago,

so I can only offer 40k now, even though your price is 100k (and the buyer

might have paid that 100k if they didn’t know about the previous

sale). Beyond that, as a buyer who is making a big investment, if you buy a 3

letter .COM or better and the sale is public AND you try to resell in the near

future, all future buyers will use that sale price as a gauge to it’s value

(irrespective to what the domain’s true investor value is) so your

investment potential would be massively limited."

"So privacy is the first thing we changed," Bostick continued,

"but beyond that, we just tried to develop the perfect platform in

general specifically designed for high value domains. In this, we have buyer

exclusivity (no seller exclusivity), buyers need to accredit themselves

(via identity or fund verification) to unlock more than 5 listings, and we do

everything on the platform (appraisals, seller vetting, buyer sourcing, &

escrow) so that we can do deals faster than anyone else. We’ve closed

a couple deals safely in the 5/6 figure range within 24 hours (from offer

accepted to seller paid) using these methods - out of the 50-100 marketplaces

that are out there, not many can claim to be able to do such big deals so

quickly (or offers such full service for the fees we’re charging)."

|

Asked

for more details on how Graen's buyer exclusivity (rather than seller

exclusivity) policy works, Neil said, "If

a buyer uncovers a domain, they sign an NDA and agree to not

share any details about the offering (or try to go around the

platform) for fear of legal action. We just ask that if the seller

lists their domain on other marketplaces (or with other brokers), that

they price their domain better than it’s listed with anyone else -

because of our low commission and private placement, most sellers are

able to. If we find a domain on our site with a price listed lower

somewhere else, we will likely take it down until pricing is changed. Exclusivity

is important as it maintains a place where buyers and sellers

take |

Image

from Bigstock |

|

the

platform seriously - we just switched the model in being the first

platform to make buyer exclusivity a main differentiator. As

it is a huge ‘sellers market’ in domains right now, to be a

marketplace that is competing, you need to put your sellers first

and foremost. That is exactly what we are doing and why we have

almost 500 users on the platform already, within one month of

launch." |

As

we noted at the top of this article, Graen is not designed for everyone. Bostic

said, "To be clear, our

superior marketplace experience for high value domains comes at a cost for

other users - it is not a good match (or very helpful) for people selling

quality domains right now (and is especially not good for people trying to

list a lot of domains at once). That said, in the near future, we will be

offering new premium services for the everyday domain investors including

exclusive landing pages with broker representation for only 3-9% success fees

with no caps on prices or quantity of domains listed."

|

Image

from Bigstock |

"We

are not a marketplace with brokerage options, we are a curated

marketplace (or application-only marketplace). This is a core

part of our strategy that differentiates us as it allows us to

maintain quality on our marketplace like no one else can. Another

problem with almost all marketplaces as a buyer (and as a seller) is

that they have too many bad quality domains. The effects of this

are that buyers don’t spend the time finding serious deals on there

and sellers won’t list good deals because they know that chances of

buyer coming through the cracks is low. Since we limit the amount of

listings, we can automatically get more serious user exposure to

each individual listing. Beyond that, since I still have my

connections and network as a broker, I see all domains listed and work

to get them sold outside of the platform (based on who I know is

buying). Through this model, we can maintain a sell-through rate light

years higher than any other domain marketplace will be able to,"

Bostick said. |

Though

Graen has just launched, today's Graen is unlikely to be the final iteration.

"Since launching a month

or so ago, we’ve changed the platform a lot based on buyer & seller

feedback," Bostick noted. "For example, we previously didn’t give

any ‘freebie’ investor passes (the things that allow you to uncover

listings), and we now we give 5. We also now have implemented new value

attributes (including comparable sales on each listing) and we have

implemented an affiliate program to incentivize users to band together

as a community and mutually benefit from referrals. We are still taking

feedback as one of my main assets is our full time development team that

includes our CTO and two full time coders - so if anyone has any suggestions

for the platform, if it fits our model recommend it and you may be able to

see it live within a week!"

|

|

(Posted

November 11, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211111.htm

*****

|

|

IT.com

Put Its New Domain Registration

Platform in the Spotlight at

WebSummit 2021

|

|

Over

42,000 people,

representing leading tech companies

from around the world, gathered in

Lisbon, Portugal this week

for the massive Web Summit 2021

conference that ended Thursday

(November 4). Intis

Telecom, the new

owners of IT.com (just

purchased in a $3.8

million

transaction we

told you more about earlier this

week), was there to showcase their

new prize acquisition.

Intis

is now using IT.com to sell

third level domain

registrations under the marquee

name. For example, names like

keyword.it.com can be registered

at a retail cost

|

|

|

of

$49. Intis also owns UK.IT and

throughout this year the company

has been buying up two-letter .IT

domains in other extensions

including .hn, .to, .ax, .sb, .uy,

.tn, .by, kz, .ae and .broker

with the prices they paid for

IT in those TLDs ranging from

$2,000 up to $25,000.

The new 3rd level registration

service will be offered on all of

those extensions as well.

Above:

Web Summit 2021 attendees visiting

the IT.com booth at the

international event held this week

in Lisbon, Portugal.

Below

(left to right): Dignitaries in

this shot from the IT.com booth at

Web Summit are Munir

Badr (Owner,

AEserver.com), Andrey

Insarov (Founder and

CEO, IntisTele.com and IT.COM), Sergey

Nesmachny (Business

Development Director, WiFly.net)

and Alexey

Sergeev (Founder,

sigmasms.com).

Web

Summit won't be the last place

where IT.com will have a high

profile. The company plans to

sponsor, exhibit and meet

attendees at a variety of key

events in the

telecommunications and domain name

industries over the course of the

upcoming year.

|

|

(Posted

November 5, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211105.htm

*****

|

|

Measuring

Success: Domain Registrations Are

Surging But What Happens When It's

Time to Renew?

|

|

Life is good

for a lot of people in the domain

business these days. Aftermarket

sales are booming, savvy registry

operators are seeing total

registrations rise in their

TLDs and competitive registrars

are watching their domains

under management (DUM)

soar.

While

sales, registrations and DUM are

the metrics we hear most often,

there is another one that is especially

critical in measuring true success

on the registration side of the

business. That is domain

renewal rates. If most

of your customers, whether they are

investors or developers, are

consistently renewing their domains

that's the best news of all for a

TLD operator. Renewal rates are especially

important for new gTLD (nTLD)

registries that offer a low,

|

Image

from Bigstock

|

|

introductory first year price

before trying to collect their regular rate at renewal time. That's

when the rubber meets the road and registries

see if

customers see value in

their TLDs.

|

|

We

got some extensive data-based

insight from Neha Naik,

Sr. Director of Channel

Partnerships at Radix,

into what one of the more

successful operators of multiple

TLDs has been seeing on the

renewal front.

Neha

noted, "When Covid hit in early 2020, domain names, along with all

sorts of digital products and services, saw a sharp boost followed by a

sustainable acceleration in growth. A report by McKinsey claimed that

10

years’ worth of progress in terms of ecommerce

transition was achieved within the first three months of the

lockdown. IBM said it was worth 5

years of digital progress. Adobe said that's between 4

to 6 years.

With

this came heightened activity in new business formations and existing

businesses going online to maintain continuity. This led to a direct

increase in the demand for domain names and other products related to

building websites.

The

overall domain market saw a significant jump in new registrations in

the first few months. At Radix, we saw that .online and

.store had the most uptake, growing by over 60%* between 2019 and

2020. Our other TLDs including .site, .fun and .tech also

saw a spike in registrations."

|

Neha

Naik

Sr. Director of Channel

Partnerships

Radix |

"Historically,

major events like this have been the trigger for disruption and change,

Neha said. "This time around, the pandemic ushered in a new spurt in

doing business online to the extent that owning a website was no-more a

good-to-have. It was a must. After all, do you even exist if you are

not available online in a post-pandemic world that we live in?

It

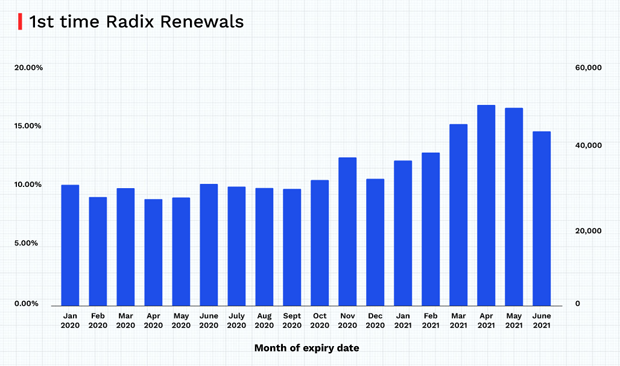

has been over a year since we witnessed these major market shifts. Looking

at the domain registration and renewals data since then led us to some

interesting insights about the market in general and our TLDs in particular.

When reviewing 1st time renewal rates for nTLDs registered in

the Jan - June 2020 period, the aggregate first time renewal rate remained

steady, very similar to 2019. Details of the collection of data and the

methodology used is explained in the notes below.**

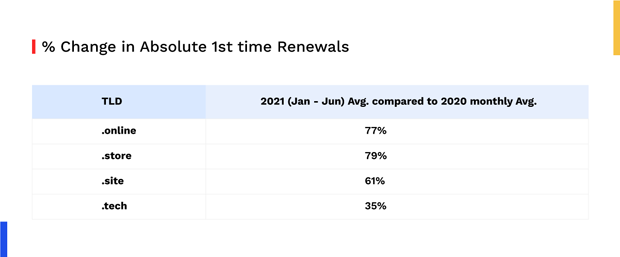

The

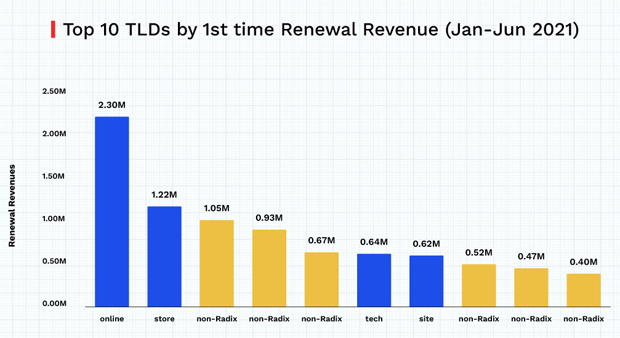

nTLDs that make up the top 10 in terms of absolute renewals (based on a

monthly average) also remain the same. Most of them, however, have seen significant

growth in their 2021 monthly renewal numbers (absolute count of

renewals). Specifically looking at Radix TLDs, we see that .online, .store

and .site have seen a 60%+ increase in absolute first-time

renewals, and .tech has seen a growth of 35% for the same

period."

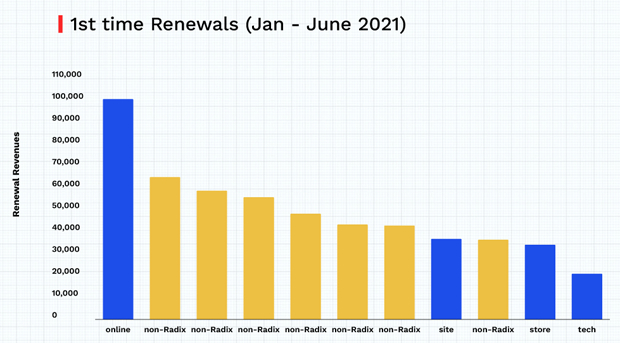

Putting

this into perspective, below is

a stacked view of the first time

renewals for .online in

comparison with other nTLDs, and

ranked by the absolute number of

1st time renewals.

.online

has 60% higher first time

renewals compared to the next

ranked nTLD. Other

Radix TLDs make up for over 30%

of the top 10 renewals market

share.

"As renewals and renewal revenue are much more concrete indicators of market success

versus sheer registration volume, we took our study one step further to determine the renewal revenue generated for

Registrars," Neha said. "In order to do this, we used the 3rd party renewal data and applied standard renewal costs across registrars, assuming that the margin across TLDs will be more or less the same. We then stacked up all nTLDs in the order of those that generate the most renewal revenue for the

industry as shown in this graph:"

|

|

|

".online

leads the charts by adding over $2.3 million in first time renewal revenue (this does not include the registrar markup on registry cost), followed by .store

at rank 2, adding over $1.2 million in first time renewal revenue.

This revenue only includes 1st time renewals and doesn’t account for annuity premium renewal revenue

either," Neha added.

|

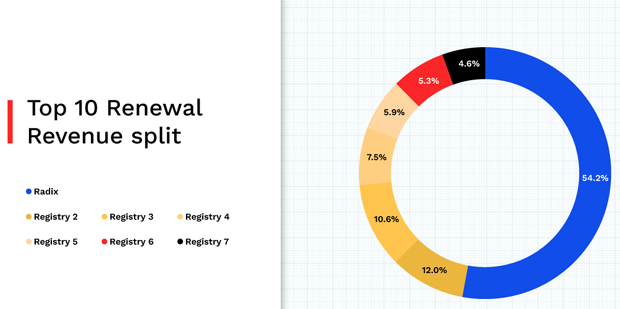

"It is worth noting that

.online alone accounts for

26% of overall renewal revenue amongst the top 10 nTLDs. And the 4 Radix TLDs that appear in the top 10 above account for

54% of the total renewal revenue generated by the top 10 nTLDs,"

Neha noted.

"While these are promising numbers, we will continue to track the performance of renewals through the next few months as well. We are eager to see how things shape up as we move beyond the peak of the pandemic."

Neha commented on why Radix

examines their renewal results

in such detail. She said, "At Radix, we have a fundamental belief:

you cannot improve what you don’t

measure. Constantly looking at the scoreboard is how we track the health and growth of the business. That the domain industry is the most measurable industry in the world only makes data tracking a lot more comprehensive."

"We understand that a TLD’s renewal performance is also

an indicator of the quality of its domains under

management. Ultimately, the true measure of success for any nTLD is qualitative usage, a goal fulfilled by marketing strategy and focus on renewals.

This philosophy has led to many innovative marketing initiatives that are reflected in the awareness campaigns we have executed in the recent past. From startin.tech to

pitch.tech to academy.get.online, Radix’s marketing campaigns are about enablement of new businesses."

"After all, the

growth in the domain industry is dependent on the growth in

businesses, old and new, going online. For us and the industry on the whole, it’s a unique opportunity to be at the starting point of the web presence of a business and

we’re excited about the times

ahead," Neha said in

closing.

Notes:

* This compared new registrations numbers between 2020 and 2019, and excludes registrations from Chinese registrars.

* All data excludes data from Chinese registrars. Given that the China market has differential pricing and other market nuances, the geo has been left out of this study. |

|

|

|

(Posted

November 2, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211102.htm

*****

|

|

Update

on $3.8M IT.com Sale Including

Payment Plan and New Use of Domain

to Sell IT.com Sub-Domains

|

|

Just

minutes after

we completed our latest bi-weekly domain

sales report we got a

quick note from veteran broker James

Booth letting us know he had

closed a $3.8 million deal

for IT.com - the highest

publicly reported price for a

domain sale so far this year.

Since then I have gotten more

details on the transaction and am

able to tell you that James served

as the broker for the seller. The

buyer was represented by Igor

Furdyk who, in addition to

being a veteran domain

broker, is a Project

Manager at Intis

Telecom (the domain

buyer) and also Head of Sales

for the new domain registration

service that, as of today,

began operations on IT.com.

IT.com

follows the model that CentralNic

has employed for years with top tier two-letter .com domains -

which is using them as the

|

Image

from Bigstock

|

|

base to sell third level sub-domain registrations. For example, with the

IT.com site now open, names like dnjournal.it.com can be registered at a

retail cost of $49. IT.com is launching an ambitious marketing campaign

including a high profile presence at the 2021 WebSummit

conference in Lisbon, Portugal that runs today (November 1) through

Thursday.

UK-based

Intis also owns UK.IT and throughout this year the company has been buying

up two-letter .IT domains in other extensions including .hn, .to, .ax, .sb,

.uy, .tn, .by, kz, .ae and .broker with the prices they paid for

IT in those TLDs ranging from $2,000 up to $25,000. The new

3rd level registration service will be offered on all of those extensions as

well.

Igor

also provided us with documentation showing that full payment for IT.com is

being made over a three-year period that follows a $1.5 million down

payment. While the $3.8 million deal is the biggest one publicly report so

far this year, we don't chart sales until payment has been fully completed,

so Hippo.com at $3.3 million will remain in the #1 position on

our 2021 YTD Top 100 Sale

Chart. No matter how you slice it, it is a terrific acquisition

for UK-based Intis Telecom and a major feather in the cap for brokers James

Booth and Igor Furdyk.

|

|

(Posted

November 1, 2021) To refer others to the

post above only (and not the full Lowdown column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2021/dailyposts/20211101.htm

*****

|

|