|

|

|

|

|

|

| |

|

|

The

Lowdown

Welcome to the

The Lowdown from

DN Journal - your source for notable news and information from all

corners of the global domain name industry!

The Lowdown is

compiled by DN Journal Editor & Publisher

Ron Jackson.

|

|

|

Subscribe

to our

RSS Feed

|

|

|

|

.HipHop

Launches Equity Crowdfunding Campaign With DJ

Madout as Lead Investor |

|

The .HipHop

domain registry has opened an equity

crowdfunding campaign with a "Testing the

Waters" phase on Wefunder.

Cultural innovator DJ

Madout signed on as Lead Investor for

a campaign that invites investors and the global

Hip Hop community to claim a stake in the

ICANN approved registry that represents them on the Internet. DJ Madout is known for his

dedication to amplifying Hip Hop culture

around the globe. He got on board the funding

campaign because he believe it presents a unique

opportunity for artists, DJs, producers,

entrepreneurs, and fans to own a piece of the

digital real estate that .HipHop provides.

DJ Madout said,

"Hip Hop is more than music — it’s a

movement, a culture, and a legacy. By

supporting .HipHop, I’m ensuring the culture

owns its digital foundation. This is an

investment in the future of Hip Hop, for the

community and ultimately by the community."

The

.HipHop team, led by a cultural entrepreneur and

domain industry veterans (including one of its

earliest pioneers in Monte Cahn), that

represent a combination of proven executive

experience and roughly $600 million in

lifetime domain sales. That team has made it their

mission to empower creators, fans and businesses

with the most culturally aligned and brandable web

address. |

DJ

Madout

|

|

Through

Wefunder, supporters can reserve investments starting

at $250 and play a roll of their own in helping

shape the future of Hip Hop online. The

registry cited three primary reasons for why they

believe .HipHop provides a unique investment

opportunity:

-

Cultural

Ownership: Hip Hop DJs, artists and brands

gain control over their online identities with

domains like DJName.HipHop and ArtistName.HipHop.

-

Proven

Leadership: Members of the founding team

have decades of experience in domain sales,

marketing, and internet governance.

-

High-Growth

Potential: With over 2 billion global Hip

Hop fans, the .HipHop domain has significant

untapped potential.

The investment

opportunity comes with this disclaimer:

We

are "testing the waters" to gauge

investor interest in an offering under

Regulation Crowdfunding. No money or other

consideration is being solicited, and if sent in

response, it will not be accepted. No offer to buy

securities can be accepted, and no part of the

purchase price can be received, until a Form C is

filed and only through Wefunder’s platform. Any

indication of interest involves no obligation or

commitment of any kind.

|

|

(Posted

Sept. 16, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0916.htm

*****

|

|

After

a 6-Year Absence India's DomainX Conference Staged

a Big Comeback With 2025 Event in New Delhi |

|

After a

six-year hiatus, the curtain went back up in India's

DomainX

conference August 30-31, 2025 at the Radisson

Blu Plaza Hotel, Delhi Airport

in New Delhi. One of the original founders

of the event that ran annually from 2014-2019 (and

its current CEO), Manmeet Pal Singh, helped

orchestrate the DomainX revival. The shutdown was

precipitated by the start of the Covid pandemic in

2020 but with the global domain industry enjoying

a rapid expansion and the popularity of new events

like London's Domain

Summit and Domain

Days Dubai, this looked like a good

time for the Indian domain community to step back

into the spotlight. |

|

|

Above:

The traditional opening ceremony that was a

hallmark of previous DomainX conferences kicked off

the 2025 event. Manmeet

told us, "We clocked approximately 140-150

participants on both days of the event with Dynadot

flying in VP of Aftermarket Hallie Cao from

the U.S. at the last minute and representatives from

Lars Jensen’s registry, .ICU, represented

by his local team based out of Mumbai." Another

one of this year's full-time DomainX organizers,

Growth Engineer and SEO Scientist Shailendra

Mishra (Founder & Director at Milestone

Machine LLP) told us, "On the event's opening

day, New Delhi experienced unexpectedly bad weather.

This resulted in some delays for arriving guests,

but it certainly didn't dampen anyone's

enthusiasm. All speakers presented stellar

insights and personal anecdotes. We were also happy

that Mr. Ajay Data, despite a sudden health

decline, was able to join us digitally via Google

Meet and give us some fantastic insights on the

use of AI in several aspects of brand

building and brand protection for businesses.

One

of the highlights of DomainX 2025 was this Fireside

Chat featuring (left to right) Moderator Shailendra

Mishra, Manmeet Pal Singh, Harmandeep Singh

and Vinesh Bhaskarla. Shailendra

noted, "For the first time ever, we also held a

one-day Domain Investment Workshop adjacent

to the annual conference, which was very well

received. Manmeet Pal Singh, Vinesh

Bhaskarla and I hared details advice on domain

name investment, tips, and tricks."

A

photo from the Domain Investment Workshop at Domain

2025 with a special guest,

Dyandot VP of Aftermarket Hallie Cao (3rd from

right). Shailendra

said, "I am glad that we had representatives

from ICANN, registries, and registrars

available for networking and learning" He also

pointed to several specific talks that were personal

highlights. "Mr. Manoj Dhanda, who

rebranded his cloud server company from Microhost

to utho.com

a couple of years back, shared great insights into

the 'ins and outs' of that process and its expected

and unexpected benefits. Mr. Rodney Ryder and

Mr. Ankur Raheja, both well-known legal

experts and IP lawyers, provided their respective

case studies and numerous recent domain dispute

cases they've handled, significantly improving our

understanding of brand protection and infringement

avoidance." "Also,

Mr. Manmeet Pal Singh presented his recent domain

sales and negotiation stories, making the

session tenfold more energetic and I had the fortune

to participate in a couple of panel discussions in

which we covered numerous sales tactics from both

business and domainer perspectives."

As

always, the biggest benefits from attending DomainX

come from new relationships made and existing ones strengthened. "The

Indian domain name market remains promising for both

new and established players," Shailendra said.

"The startup ecosystem is not just

growing; but maturing rapidly. There's a

noticeable shift towards a more sophisticated

understanding of domain assets as integral

components of digital strategy, rather than just

technical necessities."

"We saw an impressive and enthusiastic turnout,

filling the hall with a diverse mix of domain

investors, brand owners, legal professionals, and

digital marketers. The energy at the conference

clearly demonstrated a strong appetite for

knowledge, collaboration, and innovation, suggesting

a very positive trajectory for the Indian domain

ecosystem in the coming years," he concluded.

The

closing "class photo" from DomainX 2025!

|

|

(Posted

September 8, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0908.htm

*****

|

|

Scenes

from the 2025 Domain Summit Conference That

Completed Its 3-Day Run Wednesday Evening in

London |

|

Editor's

Note: Our new full

Domain Summit conference review has

now been published so you can get a complete

summary of this year's event. |

|

The 2025

Domain

Summit conference closed this evening

in London, England. This year's event was

held in a new venue, the city's roomy and

conveniently located Business Design Centre.

Domain Summit has been an annual event in London

but from this point forward it is branching out

with additional events around the globe

(the next of those will be Domain

Summit Africa, coming up next February

in Nairobi). With that expansion, this year's

London event was dedicated to the European

market, though it will continue to attract

attendees from all over the world as it did again

this week. |

|

|

When the

conference releases their official photos from this

year's event we will put together a full review of

the conference for you. In the meantime, as an appetizer,

we gathered a few scenes posted by attendees on

social media to give you a taste of what transpired

in London over the past three days.

Above:

London's Business Design Center

where the 2025 Domain Summit was held this week. Below:

While the conference ran Tuesday and Wednesday,

September 2 & 3, some of those who arrived

early were treated to a tour, drinks and

snacks at Team

Internet's London headquarters Monday

afternoon (September 1).

Above:

On Monday evening, the pre-show activities

continued with a Networking Party at a

classic UK pub nearby. Below:

Bright and early Tuesday morning Domain Summit

Founder Helmuts Meskonis (at left) made his way around the London Design Centre

to welcome sponsors and exhibitors (including DN.com's

Jack Dai, at right) to this year's show.

Above:

Three global partners signed on with Domain

Summit to support the event's global expansion.

They include .it.com

Domains, Freename

and Site.pro.

Here you see .it.com Domans Founder Antony

Insarov (at left) and Chief Strategy Officer

Joe Alagna (at right) visiting the aeserver.com

booth manned by Founder Munir Badr. Munir, of

course, is also widely known as the Founder of Domain

Days Dubai (the 2025 edition of that

popular event is coming up next month). Below:

Out on the Exhibit Hall floor, Sedo's

"Mr. Premium" Mark Ghoriafi (at

left) took the opportunity to chat with Jeff

Nyman (Digital New Media).

Above:

Dozens of business sessions were presented on

two separate tracks over Domain Summit's two

business days. You can see

the full agenda from the show here.

Photo credit: Gherardo Varani (Freename). Below:

The sessions began at 10am Monday with an

eye-opening Keynote from Team

Internet CEO Michael Riedl.

Above:

Above.com

Aftermarket General Manager Nathan Parker (at

right with Senior Account Manager Jodi

Chamberlain) joined Sedo's Mark Ghoriafi on

stage for Broker Talk, one of

Wednesday's most popular business sessions. Below:

Some more of the many familiar faces in the

Domain Summit crowd, (left to right) James Barker,

James Iles (GoDaddy),

Leanne McMahon (Crunch.id)

and Lee Lovell (DNX.com).

By

all accounts we've seen, just hours after

closing, Domain Summit 2025 is already

being hailed as another highly productive event for

those who were there to experience it first hand.

More to come!

|

|

(Posted

Sept. 3, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0903.htm

*****

|

|

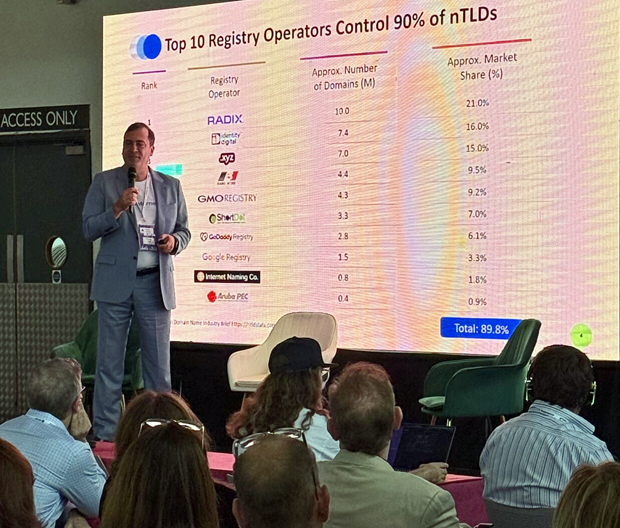

Radix

Reports Their Best Six-Month Stretch of Premium

Domain Registrations to Date |

|

If you

have been following our bi-weekly domain

sales reports this year, you already

know the domain aftermarket has been on fire.

However, that's not the only sector where sales

are exploding. Radix

(the administrator of ten new gTLDs including .tech,

.fun, .online and .store

among others) just announced the number of premium

domain registrations they had in the 1st

Half of 2025 (.pdf) soared 50%

higher than the same half last year. The

Radix onslaught was led by an eye-popping

expansion in .tech registrations as they

rocketed 70% above the previous half

(2H-2024). In the latest half alone .tech had 32

registrations at $5,000 a year, 10 at $10,000

a year a single-character reg at $25,000

a year (the renewal cost for premiums is the same

as the initial fee). |

|

|

While .tech enjoyed the highest rate of growth,

.fun was also busy having a good time as they

brought in highest overall number of premium Radix

registrations as shown in the table below:

Though

the cost for premium domains is substantial, Radix

saw solid renewal numbers for

theirs. 57% renewed after the first year. The

percentage of those who renewed for a second time

rose to 73% and once they reached a third

renewal (and subsequent ones), 85% of the

registrants re-upped. There are more interesting

details in the full report that you can read

here.

|

|

(Posted

August 22, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0822.htm

*****

|

|

India's

DOMAINX Conference is Back! After 6 Successful

Events Followed By a 6-Year Hiatus the Curtain is

Going Back Up in New Delhi |

|

India

has always had one of the most passionate and

productive communities in the global domain

industry. In every field - investing, developing,

legal services, social media, entrepreneurial

ventures and more - the country is well

represented at the head of the class. Back in the

early 2000s, when the domain business was starting

to explode, people were speculating about

who among them might become the industry's first billionaire.

As it turned out it would be the first two

billionaires - India's personable Turakhia

brothers, Divyank and Bhavin, who

founded Directi and went on to create many

other wildly successful enterprises. So,

in 2014 we were already paying attention

when a new India-centric conference, DomainX,

was organized by its current CEO, Manmeet

Pal Singh, and fellow movers and

shakers in that country. The event was held in Hyderabad

and, though I wasn't there in person, I

participated remotely by doing a live video

interview with Michael

Castello for the audience. The next

year, ten years ago this month, I flew over to

speak at the 2015

event in Bangalore. The event, people

and country were amazing and many great

relationships came out of that unique opportunity

to connect with everyone face to face. |

|

|

The

DomainX train kept right on rolling until the last

edition in New Delhi in 2019. At the time, no one had any idea that would be the

last DomainX for years to come but, as we all

know now, 2020 and the global Covid pandemic,

disrupted everyone's plans. Thankfully, those days

are behind us now and the DomainX curtain will rise

again when the show returns to New Delhi for

an August 30 & 31, 2025 event at the Radisson

Blu Plaza Hotel, Delhi Airport. As was the case

with all previous DomainX events, guests will hear

from an outstanding line up of speakers

and enjoy a diverse business and social agenda.

|

Manmeet

Pal Singh

DOMAINX CEO |

A lot of water has gone under the domain bridge

since the last DomainX event, so there will

be a lot to catch up on. Manmeet told us,

"The Indian domain investment market

has matured significantly over the past

decade, with domain investors becoming

more data-driven and globally connected.

While premium .com names remain the

strongest asset class, we’ve also seen

increased activity in ccTLDs like .in

and .co.in, particularly for startups

targeting the Indian consumer market" "The challenge many domain investors still

face is liquidity—moving inventory

at sustainable margins, especially when

end-users are price-sensitive. Plus, NIXI

(operator of .in and .co.in) aren’t

supportive of ccTLD domain investors.

However, the rise of AI-driven businesses

and digital-first ventures has opened

new opportunities for keyword-rich brandable

domains. The key for Indian domain investors

has been patience and an international

outlook, as many successful sales still

come from overseas buyers in .com and other

new gTLDs." |

|

Manmeet added, "What’s been working well is focusing on

quality over quantity—curating domain

portfolios with strong one and two keyword

.coms, short brandables, and premium .in

domains that align with India’s digital

growth story. Networking at global

events and platforms like DOMAINX has

also helped investors position themselves

better in the international market. Indian

domain investors who adapt to global trends,

build relationships with end-users, and

understand the nuances of branding are

seeing real success, while those relying

solely on bulk registrations are struggling.

I strongly feel that the real wins

are coming from domain investors who think

globally, but also understand the

branding needs of India’s fast-growing

digital economy." |

|

One of the many

leaders from India's domain community that I

first met and heard speak at that 2015 event

was attorney Rodney D. Ryder (Scriboard.com)

Mr. Ryder, who deals with a lot of domain

issues at the corporate level told us,

"Domain names are vital to the

Indian business and corporate ecosystem.

Brand owners and brand-driven organizations

are learning the importance of acquiring and

owning crucial digital real estate -

like the .com and .ai. In the

Indian context, we have also seen increased

awareness resulting in litigation, online

dispute resolution and digital brand

management. The domain name ecosystem and

online brand management is rapidly

scaling in India as brands are deploying

resources on an exponential scale in order

to prevail in a highly competitive yet

thriving start-up ecosystem." |

Rodney

D. Ryder

Founding Partner, Scriboard |

|

Mr.

Ryder will be speaking again at DOMAINX

2025, as will another top notch attorney

I met at the Bangalore event in 2015, Ankur

Raheja. ICANN will also be

represented alongside many successful

business leaders, brokers and individual

investors. All of that insight will be

available to attendees comes at an extraordinarily

low cost with ticket

prices starting at ₹3,499

(~ $40). |

|

|

(Posted

August 20, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0820.htm

*****

|

|

PIR

to Distribute Over $200,000 to Newly Named 2025

.ORG Impact Awards Finalists at Ceremony

Featuring Celebrity Host Common |

|

Public Interest

Registry (PIR), the people behind the .ORG

domain, have named 35

finalists for the 7th annual .ORG

Impact Awards. These special awards recognize

outstanding mission-driven individuals and

organizations from around the world for their

positive contributions to society. The honorees

were chosen from seven different categories with

five finalists selected in each category.

All

finalists, which range from a women-led

nonprofit transforming lives in East Africa, to an

organization recycling hair into tools to help the

environment, to a .ORG using AI to teach sign

language across Latin America, will receive

donations of $2,500 each and that will be

just the beginning for many of them. The winner in

each category will receive an additional

$10,000 and the .ORG of the Year award

winner will take home a $50,000

donation.

Beyond the cash donations, being named winners in these award

categories and the prestigious .ORG of the Year,

will help raise the profile of the

honorees, ultimately driving donations,

funding, talent acquisition, partnership

development, and increasing audience reach. |

|

|

The finalists,

who were chosen from a starting field of over 3,000

applicants, will be invited to Washington,

D.C. for a gala awards ceremony that

will be held there on October 7, 2025.

Each year PIR brings in a special celebrity that

is well known for their own good works to host

the Awards Ceremony. This year it will a man

of many talents - Common, the first rapper/artist to win a Grammy, Oscar and Emmy

and star of the Apple TV+ show Silo.

Common is also the founder of the nonprofit Free

to Dream, which works across four

pillars — education, justice, wellness, and

jobs — to create the conditions necessary

for dreams to come true. Free To Dream

reflects 20 years of Common's

leadership as a changemaker, using his

entertainment platform to advance critical

social causes.

“I’m passionate about making sure youth in the U.S. are able to

see positive role models and pathways

to achieve their dreams, especially those

involved in the |

Common |

|

justice system, so it’s inspiring to see people from all over the

world creating positive change for the next

generation in their communities,” Common said.

“I’m excited to celebrate the hard

work of these organizations and individuals

creating powerful change at this year’s .ORG

Impact Awards.” |

|

Jon

Nevett

President & CEO

Public Interest Registry |

Jon Nevett,

President and CEO of Public Interest Registry,

said “The .ORG Impact Awards continues to be one of the most

meaningful initiatives we look forward to all

year, and I’m honored to welcome the

extraordinary 2025 finalists to our global

.ORG Community. These finalists represent the

very best of our community — their

dedication and impact embody the very spirit

of the .ORG domain.

We’re thrilled to have

Common join us and help uplift the

forward-thinking changemakers honored at this

year’s awards. A long-time advocate for

criminal justice and youth empowerment,

Common is a changemaker himself and brings a

powerful voice to this celebration of

purpose-driven work.”

The

seven categories that make up the Impact

Awards are Community

Building, Quality

Education for All, Environmental

Stewardship, Diversity, Equity and

Inclusion, Health and Healing, Hunger

and Poverty and Rising Stars

(leaders under 30 making a difference in their

communities). You can see the full

list of finalists here, as well as

additional information at the Impact Awards,

|

|

|

(Posted

August 18, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0818.htm

*****

|

|

Sedo's

Mark Ghoriafi Closes Law.ai Sale in One of the

Biggest .AI Transactions to Date |

|

In our

latest bi-weekly domain

sales report that came out last night

(August 13), the main takeaway was how thoroughly .com

and .ai were now dominating the high end of

the domain aftermarket. On our latest Top 20 Sales

Chart every entry except one was either a

.com or a .ai. So, it wasn't a big surprise to

learn less than 24 hours later that Law.ai

has just changed hands for $350,000 in the

3rd highest .ai sale ever reported, exceeded only

by You.ai at $700,000 in 2023 and Cloud.ai

at $600,000 last month. The

person who brokered the Law.ai sale - Sedo's

Mark "Mr. Premium" Ghoriafi, was not

a surprise either. Mark already held three of the

Top 20 publicly reported sales

year to date in |

Image

from Bigstock

|

|

Double.com

($980,000), Pack.com ($600,000) and Dollars.com

($500,000). Now he has four with Law.ai to be added

to our YTD Top 100 when we publish our next

bi-weekly update August 27.

|

Mark

represented the seller in the Law.ai

negotiations and, as is the case with many

high end transactions, it took considerable

time, effort and patience to get the

deal done. As just one example, Arch.com is #2 on

our latest chart after selling for $701,000. Mark

Daniel at Domain Holdings Group

brokered that sale and he told me he had started

working on it 7 years ago! That kind

of tenacity is what separates the top

brokers from the pack and Mark Ghoriafi has

it as well.

Mr.

Premium told me, "I first

established communication with the

subsequent buyer of Law.ai in 2024 but

the initial talks didn't produce a final

outcome. Communication was re-established in

June of this year and after several more

weeks of talks the $350,000 agreement

was achieved."

Mark

added, "There will often be bumps in

the road with with domain sales. Being able

to find amicable and accommodating paths

to satisfy all parties is key for victory.

Follow-up, flexibility, and a polite flow of

conversation helped get this to the finish

line. Rather than wait for opportunity,

Mark's advice is to "go create

opportunity, and navigate to success!" |

Mark

"Mr. Premium" Ghoriafi

Sedo Outbound Premium Broker |

|

|

(Posted

August 14, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0814.htm

*****

|

|

Titan

Teams Up With GoDaddy to Give Small Businesses in

Developing Markets Email Tools Designed to Spur

Growth |

It

was four years ago this month when we

first told you about an

ambitious new project launched by domain

industry pioneer and wildly successful

serial entrepreneur Bhavin Turakhia

(the founder of

Radix,

Flock

and Zeta

among other well established companies).

That story was about Titan,

Bhavin's vision for a service designed to

revolutionize business email. Since

then, Titan has flourished, propelled by one

major partnership after another that has

helped Titan Email become a go to solution

for businesses around the world, especially

smaller enterprises that want tools

tailored to their needs. Today Titan

announced their biggest leap forward to

date, a new

strategic partnership with

industry giant GoDaddy.

The partnership will enable GoDaddy's Professional

Email offering in developing markets,

coupled with Titan's AI-enabled

business email platform, to empower millions

of entrepreneurs and small businesses with

tools to grow their brand and customer

engagement. Bhavin,

who serves as Titan's CEO as well as its

Founder, said, "Our

partnership with GoDaddy marks a pivotal

moment in making cutting-edge professional

email accessible to businesses of all sizes.

By combining Titan's innovative email

offering with GoDaddy's global reach and

trusted hosting and domain services,

we're helping entrepreneurs worldwide gain a

competitive edge with tools designed to

amplify customer engagement and drive

growth." GoDaddy

Vice President of Strategic Partnerships Oliver

Hoare added: “In today's digital |

Bhavin

Turakhia

TitanFounder & CEO

|

|

landscape,

small businesses need more

than basic email - they need intelligent

tools that make it easy to connect with

customers and stimulate growth. This

partnership with Titan enables GoDaddy to

offer small businesses in developing markets

advanced email that helps drive their

success." |

Shortly

after the initial press release came out his

morning, I got on a call with Bhavin, Ninad

Raval (Titan VP, Product & Design, who

Bhavin credits with building a world class product

in Titan) and Anuj Gupta (Titan Senior Director,

Strategic Partnerships) to get some more information

on the GoDaddy partnership as well as how much

Titan's service has grown since they first appeared

on our radar. Titan's growth has been fueled by a

unique suite of features designed to elevate

business communications, including: •

AI-powered

email composition and response capabilities •

Professional email design tools and branded

templates •

Advanced tracking for email opens, attachments, and

links •

Automated appointment scheduling •

Streamlined email campaign management •

Robust security features •

Industry-leading uptime and email deliverability

rates

In

the past a lot of those attributes were

available only in software designed for much

larger companies that could have 500,000 or

more employees. Bhavin's vision was to bring

that power to the much larger universe of

small businesses, typically solopreneurs

or those with less than a handful of

employees. You might be surprised to know

that 81% of small businesses have no

employees and of those that do, half have

less than 5 employees. Bhavin

noted, "Small businesses are the

foundation of the global economy, and

they deserve the same powerful tools that

large enterprises use to succeed. Our

partnership with GoDaddy will democratize

access to these advanced email

capabilities, empowering millions of

businesses worldwide to enhance their

communication and marketing

efforts." Bhavin

and his team recognized that the needs of

small businesses were much different

than that of major corporations. For big

companies email and communications tools are

designed for collaboration with far

flung employees. |

Image

from Bigstock |

|

What

small businesses need is tools that help

them acquire customers and grow.

Titan was designed with a focus on those

needs and it is paying off. The customer

base has grown to well over 2 million

mailboxes and the deal with GoDaddy is

expected help the company hit 10 million in

the next three or four years. |

While

you can point to the Titan feature set and say that

it is better and will improve numbers - nothing

speaks louder than data and Anuj Gupta

pointed out a treasure trove of it that was compiled

in a case

study of their 4-month pilot project

with GoDaddy in developing markets. It found that

Titan delivered a 76% increase in Average

Revenue Per User and a 65% uplift in customer Net

Promoter Score

(a metric

used to gauge customer loyalty and satisfaction

) compared to their legacy email

solution. Now the service will be rolled out to

GoDaddy customers across developing markets

globally, with initial deployment scheduled in the

current Q3-2025 quarter.

|

|

(Posted

August 12, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0812.htm

*****

|

|

The

Domain Industry Gets a Valuable New Resource with

Freename's Launch of The Domain Standard |

|

The

domain industry has enjoyed extraordinary

growth over the first quarter of this century

but judging from all of the new applications

sprouting from the foundation laid by .com

and the other original domain assets, it's

starting to look like we haven't seen anything

yet. At the same time that top tier legacy domains

are exploding in value, Web3 innovations

are opening the door to a new world of "Domain

Finance" where domains can be used in

additional ways that seek to make them even

more valuable and indispensable in our

professional and personal lives. This

metamorphosis is creating a landscape where it is

increasingly difficult to keep up with everything

going on around us. The good news is that the

number of resources needed to cover it all is

growing too. One of the best we've seen to date is

a free publication from Freename

dubbed The

Domain Standard. The first

quarterly issue

has just come out in print and digital form. The

glossy print edition will primarily be distributed

at events but anyone can download

the digital edition |

|

|

that is so polished even it looks glossy online. The publication is

loaded with excellent articles, interviews with

industry leaders, charts and graphs that dissect

every aspect of the business (old and new) that make

it much easier to take in what is happening in a digital

financial universe that seems to be continually

expanding outward from the Big Bang ignited by

.com. Among those

featured in the inaugural issue are veteran domain

investors like Braden Pollock and Mike

Mann who share long list of example sales they

have made in recent years. There are top brokers

like Giuseppe Graziano (GGRG.com) and Jack

Dai (DN.com) and corporate leaders like

InterNetX CEO Elias Rendón Benger, Todd

Han, Founder of one of the world's fastest

growing registrars - Dynadot, and AEServer.com

Founder Munir Badr who also founded the Domain

Days Dubai conference. These are just a few of

the featured names most of you will already

know. Equally important are the Web3 leaders, like

Freename CEO Davide Vicini and his team, who

are playing an integral role in efforts to open up

new ways to monetize and utilize domains (fractional

ownership being one big example). You

will also find a variety of timely articles led by

the cover piece on The Rise of Domain Finance.

Then there is The Role of AI in Shaping the

Domain Industry by InterNetX's Simone

Catania, and other enlightening details on the

ongoing .ai boom. All of the bases are covered,

including .com, new TLD and ccTLD sales and trends.

|

For

me, it was especially refreshing to see one

particular thing The Domain Standard

got right that so many others got wrong over

the past 25 years. If you've been around

that long you've seen various new things

come along that proponents declared

would "make .com obsolete" only

to blow up on the launch pad. While

competition and choice is always a good

thing, they failed to realize that credibility

is even more important and you lose it with

outlandish claims backed by |

|

nothing but hot

air. Competing

successfully with a colossus like .com and

becoming a viable option requires

bringing something to the market that either

adds value to the .com foundation or

brings enough new value (and proves

it by winning market share) to stand on its

own (as .ai has done). The smartest

people in Web3 know that and are putting in

the intense work needed to build the

structure required to make their vision a

reality. They understand we are not in a

zero-sum game - there is room for many

winners in this arena and The Domain

Standard team has shown they get that by

illuminating and respecting the full

spectrum of possibilities that we are

fortunate to have in front of us now. |

Image

from Bigstock |

|

|

(Posted

August 6, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0806.htm

*****

|

|

D3

Mission to Supercharge Domains With Web3 Fuel Gets

Major Boost from InterNetX Partnership |

|

At the

start of this year we published a profile of D3, a new company founded by

domain industry pioneers Paul Stahura and Fred

Hsu (the company's CEO), that set out with the

ambitious goal of merging the Web2 and Web

3 domain worlds. The reason that is such an

appealing prospect to so many is that it would let

legacy domains take advantage of some unique

features made possible by their Web3

counterparts. One

of the most enticing of those is the ability to tokenize

existing and future domains. That would make

them more like other financial assets that can

fractionalized, staked, or bundled into different

financial products, enhancing the financial

utility and accessibility of domain ownership.

Decentralized Web3 domains are also one-time

purchases with no renewal fees. |

D3

Co-Founders Fred Hsu and Paul Stahura

|

As

we noted in our previous article, to make

this all work D3 has to convince multiple

third parties to get on board, including domain

owners, registries and registrars.

Thanks to the track record of the founders

and the convincing case that Fred Hsu has laid

out, showing how all of those parties can

benefit from D3's DomainFi network

and Doma Protocol, D3 is

making significant progress on that front. A

prime example is a newly announced

partnership

between popular registrar and IONOS

Group member InterNetX

(with 22 million domains

under management) and D3. InterNetX

CEO Elias Rendón Benger said,

"We are excited to partner with D3 to embrace the Web3 era and

redefine domains as tokenized assets

with real-world value. This integration with

Doma Protocol opens up new investment

opportunities for our clients and

resellers, including domain trading,

fractional ownership, and DeFi utilities,

while creating valuable revenue streams.

By bridging traditional domains with

blockchain, InterNetX is empowering

businesses and partners to thrive in the

decentralized digital economy while

maintaining our commitment to innovation,

security, and trust.“ |

InterNetX

CEO Elias Rendón

Benger |

With

this partnership bringing Fred Hsu and his team a

big step closer to realizing their vision, Fed added

"InterNetX's massive scale and

commitment to innovation make them the ideal partner

to demonstrate the transformative potential of

DomainFi, Doma Protocol, and the ecosystem of

registrars, investors, and users around it.“

|

|

(Posted

August 4, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0804.htm

*****

|

|

Dave

Evanson Closes $1 Million Sale of ZH.com for Sedo

Giving Them 8 of Top 20 Sales Reported Year to

Date |

|

Sedo's

Senior Sales and Brokerage Consultant Dave

Evanson has been ringing up big money

domain sales for the past 20 years and he

is still hitting them out of the park. His latest

towering blast, just closed today, was a $1,000,000

sale of ZH.com on behalf of a U.S.

seller who has owned the domain since 1994. The

buyer was undisclosed but given the fact that ZH

is the ISO code for Chinese language, it looks

like a natural for any major investor/developer in

China. Dave

has brokered many two-letter .coms over the years

with most falling in a range between $1 million and

just under $5 million. He is representing

another one right now in QW.com. Even though

two-letter .coms are trophy assets it can take a lot

of work to close a sale at |

|

|

this level and

ZH.com was no exception. Dave told us,

"It took five months to

find the right buyer. I reached out

globally and extensively about ZH.com by email,

phone, X, LI and Meta. Then I heard from Jim

at DDD.com

who found the buyer." This

is the 7th publicly reported seven-figure or

higher sale reported year to date. We will be

adding ZH.com to our YTD

Top 100 Sales Chart when it is updated

August 13, the release date for our next bi-weekly domain

sales report. As of this writing, ZH.com

gives Sedo 8 of the top 20 positions, including

another in 7-figures in GX.com at

$1,200,000. Even without ZH, Sedo already has three in the top 10 right now.

|

|

(Posted

August 1, 2025) To refer others to the post

above only (and not the full Lowdown

column) you can use this URL:

https://www.dnjournal.com/archive/lowdown/2025/dailyposts/0801.htm

*****

|

|

|

|

|

|

| |

|