|

If

you use a DDN enabled registrar you will soon be able to upload

your domains for sale through that registrar and they will

appear across the network (this functionality is already in

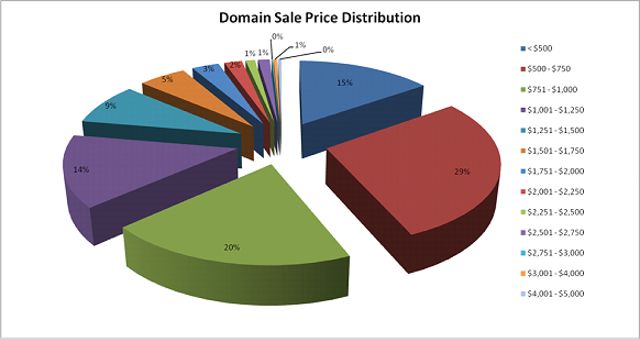

place at Fabulous.com). Sellers have to set prices between

$350-$5,000 which Warner said covers the price range commanded

by 90% of current sales. DDN’s current distribution partners

include GoDaddy, Tucows, Moniker and Fabulous

with others signed

that are to be announced soon.

|

|

Selling

through registrar sites have several advantages including brand

name recognition. For example, people trust the GoDaddy name more than the

name of an unknown seller. Also, registrars are the only ones

who can guarantee that the domain is owned by the person listing

it and that it is actually available for sale. Warner said that kind of

“quality control” currently does not exist.

|

Warner

said another major plus is that people searching for new

registrations who then discover the aftermarket represent an

entirely new source of traffic for domain sellers. Many current

sales occur from traffic generated by the owner’s domains

themselves – that is someone types in the name and discovers

it is for sale through that method.

Registrars

have already become one-stop shops where customers can get a

domain name, hosting, development services, software, etc. so Warner feels this also makes them a logical candidate to be

the primary source for aftermarket sales.

While

DDN is frequently compared to NameMedia’s AfternicDLS, Warner

said NameMedia (and other sales venues) are not competitors.

“DDN is not a reseller. It doesn’t compete with Name

Media, Sedo, Afternic or GreatDomains – which are all legacy

reseller portals. Legacy portals that believe DDN is a

competitor are misguided. The network simply enables

registrars to access contextual GEO sensitive technology, and a

database of domains which are pre-priced and available for sale

using an instant transfer protocol,”

Warner said.

“Registrars

are the only ones who can guarantee a person actually owns a

domain (when it is registered with them). They are also

the only ones that can instantly transfer those domains when the

domain owner has contractually entered an agreement to sell the

domain. Due to this they are the natural companies for

domain owners to work with to enable global distribution of

their domains. Registrars are the only ones that can

provide these checks and balances that are required to

seamlessly run transactions – comparatively legacy portals are

flying blind with no safety net,” Warner said.

| "Name

Media is frequently compared to the Domain Distribution Network

although they are not a competitor. They are the leading

aftermarket incumbent that is very good at selling their own

domain names. However, in contrast they are directly in

competition with the registrars for market share on domain sales

and now hosting and marketing services. It is easy for the

market to be confused by this, but the only way DDN competes

against Name Media is by enabling the registrars who are their

|

|

|

most serious competitors. Registrars are destined to

control most of the domain aftermarket for domains under $5,000.

Due to the scale and brand of the registrars it will be very

difficult for the legacy domain portals going forward to compete

against the registrars,”

Warner opined.

|

Though

it is a new entity, Warner said DDN is quickly reaching critical

mass. DDN was seeded with the hundreds of thousands of domains

directly owned by Fabulous.com but Warner said that is just the

start. “The DDN domain database is just about to get much

larger. Registrars are beginning to roll out the second

phase of the DDN implementation which enables a Registrar to

upload and manage domains directly into the DDN system.

You will shortly be able to go into your account with most

registrars and manage your global domain sales seamlessly

through your normal registrar interface.This new

innovation will not only enable domain sale functionality in a

proactive secure environment, but will encourage recruitment of

new domains for distribution that currently are not being used

by registrants -domains that were previously completely

inactive, even from a traffic perspective. GoDaddy.com and

Moniker.com will be going live with their owner side instant

sale protocol within weeks,”

Warner said.

“The

registrars are seriously seasoned competitors which add new

traffic and exposure to the domain aftermarket. DDN

enables the registrars to interact with each other, collects and

distributes vetting data on domains, centralizes global domain

distribution, and offers real time communication and settlement.

It provides a completely new source of domain sales traffic.”

|

|

Warner

also noted “Brand has become one of the defining issues

related to market share of the domain aftermarket. Our

research has shown that through the use of co-branding and sales

of domains via banners (directing sales traffic through to

registrars like GoDaddy) that a 150% increase in sales volume

can be achieved compared to conversions through sales portals.

When brand is proven to be this powerful and important to the

sales process, every domain portal manager should be rethinking

their current aftermarket sales strategies. Why would

anyone send traffic from their domains to a legacy portal when

they can send it to a registrar with a commonly known brand?”

he asked.

When

comparing the DDN system to other options Warner said you have

to ask these questions: What are the other provider comparisons

to DDN? Do competing technologies use contextual search

or only simple character string matching? Are their search

results

|

| relevant to location specific domains? Does

the competing solution steal the customer away from the party

providing the lead? Is there an absolute guarantee that

the domains in their database are still actively for sale or

that is isn’t fraud? Can a competing solution instantly

sell, settle and transfer domains in real time for third parties

(their domains shouldn’t be an issue and enabling only their

own domains doesn’t really count)? Does their solution

transfer domains and interact between different registrars in

real time? Are variable commissions supported on a domain

by domain basis so all domain stock is actually distributed?

What protection is in place to protect distribution partners

from legal conflicts caused by a lack of stock control?

Are the registrars they claim to have distribution deals with

the biggest registrars or just a supporting cast? Is the

distribution in-line, on the same page as the new registration

process? |

“The

Domain Distribution Network is a technological leader and a

value innovator. If a provider cannot provide at least the

basics in the preceding paragraph then they are not a comparable

provider,” Warner declared.

| Warner

has long been an advocate for making sales a key component of

any domain investment strategy. He told us, “The question to

sell or not to sell is principally an economic question.

Domain owners often look at their domains as if they were their

children. In reality they are only linear strings of

alphanumeric characters which are easier to type in than an IP

address."

"The question I like to pose is, “What revenue

multiple would you sell your whole portfolio for?” (not that I

believe in revenue multiples to determine domain sale values).

The answer usually is somewhere between 10 to 25 years revenue.

Then if you ask what is principally the same question in a

different way, “What would you sell

GenericDomainName.com for as a revenue multiple”, they usually

state some multiple that is 10 or more times the multiple of the

whole portfolio sale price. This is usually followed by a

statement that they don’t believe in selling domains. In

my view this is very flawed logic. People don’t believe

in selling domains at

|

|

| 50-500 year traffic revenue multiples, but

they do believe is selling their own portfolio for 15 to 25

years revenue? Now that doesn’t makes sense,”

Warner said.

|

“The

second argument is one that says that if they hold out they can

sell the same domains that they are not selling today for more

latter. To some degree that is true. However, the

stark reality is that even the best portfolios usually can only

sell 1% - 2% of their portfolio per year. In five years

time you may have missed the opportunity to sell say 10% of

your portfolio at 50-500 years traffic revenue multiple.

This doesn’t mean that all of a sudden you can sell 10% worth

of domains in the next year, and if you do want to sell more

then you will need to decrease your revenue multiple."

Warner

said, "The

most bizarre is when someone refuses to sell at these huge

retail revenue multiples, only to sell out later for a much

smaller multiple on the whole portfolio? Now, if you had

sold out that 10% at an average of a hundred year multiple (10%

x 100) and then sell the remaining portfolio at 15 years

multiple (90% x 15) = 2,350 vs. 1,500 if you wait.

This example shows that you lose 57% of the potential sale

revenue by waiting. Realistically, the domain prices will

go up, traffic revenue will be earned, and you may be burning

the furniture – but selling some domains all the time is a

much lower risk profile for your business and these rough

calculations still haven’t considered registration holding

costs or use of proceeds.”

“Lastly,

the theoretical portfolio of domains that don’t make back

their registration costs in traffic revenue. These domains

cost you money every year to hold them. The reality is

that every portfolio has a sub portfolio that is the same as

this theoretical portfolio. Ask the owner if they want to

sell the domains? The owner says no. Why? They

will be worth more in the future. So, you don’t want to

sell even though you don’t earn even your holding costs?

No, they are worth more than that. But, they don’t pay

for themselves? Yes, that’s right. Who’s on

First again? It is likely that on sale of your whole

portfolio that these domains will have little to no value

attributed the them and yet you still don’t want to sell

them?”

|

|

We

also asked Warner about the sustainability of the current market

boom (and how high the DDN system can fly if the sales

environment remains as friendly as it is today). “The domain

aftermarket after years of stagnation and a lack of innovation

is finally speeding ahead in leaps and bounds. The

Internet is a grand new experiment that is still cutting its

teeth, and yet everyone just happily accepted the status quo of

how aftermarket domain sales occurred. I found it bizarre

that systems that were built to enable the sale and transfer of

domain ownership would be so manual, poorly marketed, and

cumbersome. It is fantastic that so much new innovation

and marketing is occurring in the domain space. That

people are actively seeking new markets and scrapping legacy

systems and business models that were stale.”

|

“I

expect that domain values are going to strongly increase over the

next few years. The market is the market and now that it

is being more fully enabled it will find its way to a balance.

Like the stock market, domains should be seamlessly traded.

Their value should be what the market will bear and one cent

more than the under-bidder. All of the domains that are

not currently being used by authentic businesses should be

traded and sold until the single best use of each domain is

found or at least as close to a frictionless market that we can

get.”

“The

goal of the DDN system is to be the perfect enabler. Even

the 2% commission that the DDN takes as part of any transaction

is designed to be part of the market balance. The costs of

development, management, technical resources, and ongoing effort

of the DDN are roughly in balance with the expected

earnings from the endeavour. A higher commission

would have attracted hyper-competitors who would bid to control

a system which should be inherently an open platform for global

distribution. Even now it attracts competitors when no

profit is realistically to be gained. If the commission

were to be any lower the work that needs to be performed and the

robustness of the systems to run the network would be

compromised. The domain market would be a much better

place if companies sought value innovation over

hyper-competition. When aftermarket domain sales

transactions happen between all of the major registrars with

seamless transactions in real time, and the domain aftermarket

doubles in size to its current value – our goal will be

achieved.”

*****

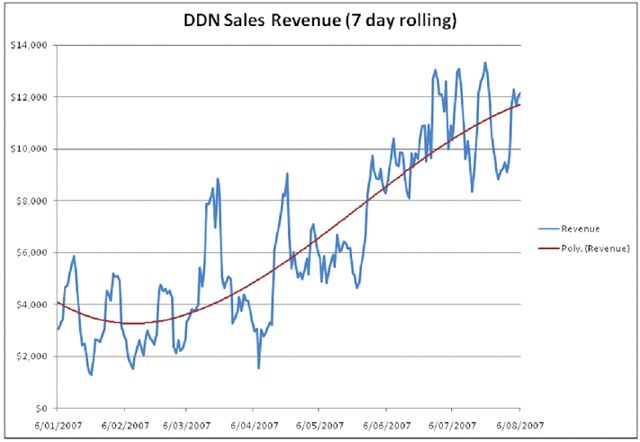

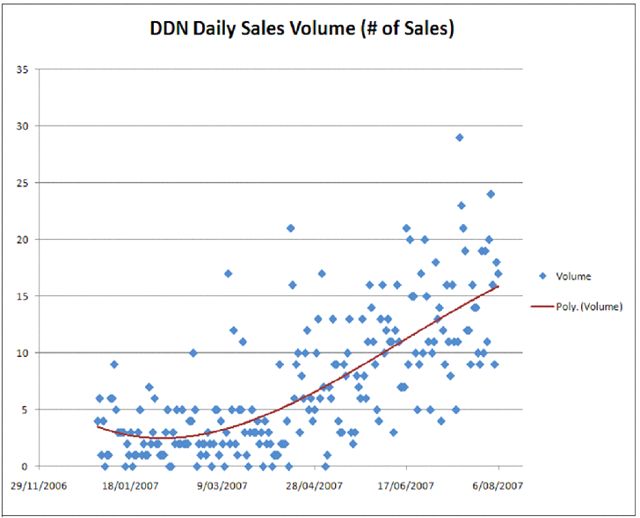

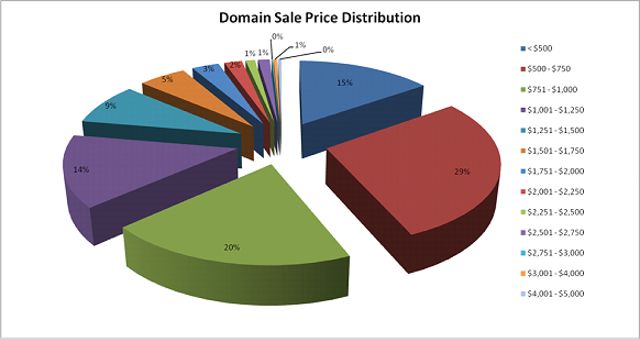

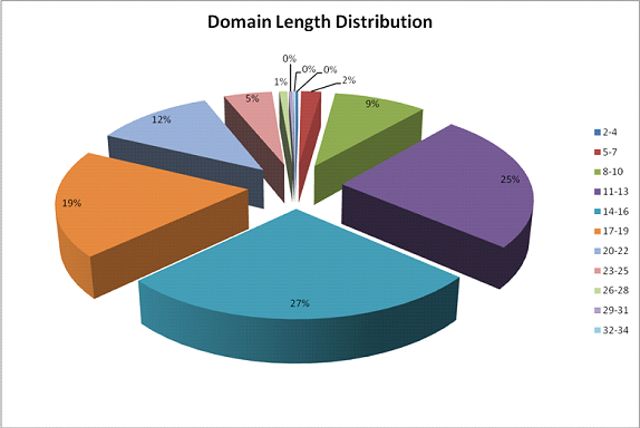

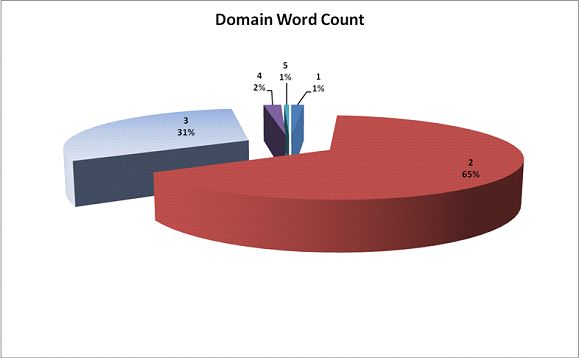

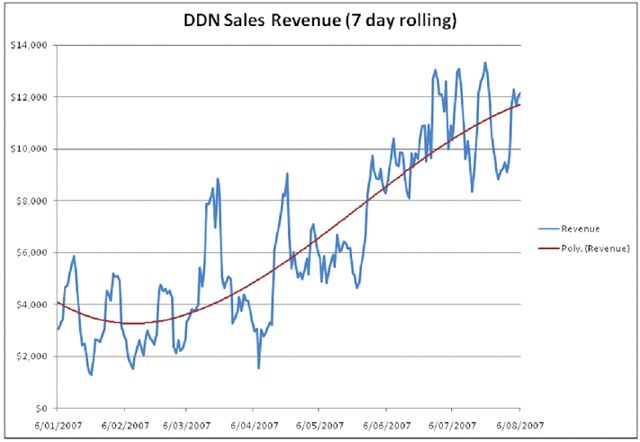

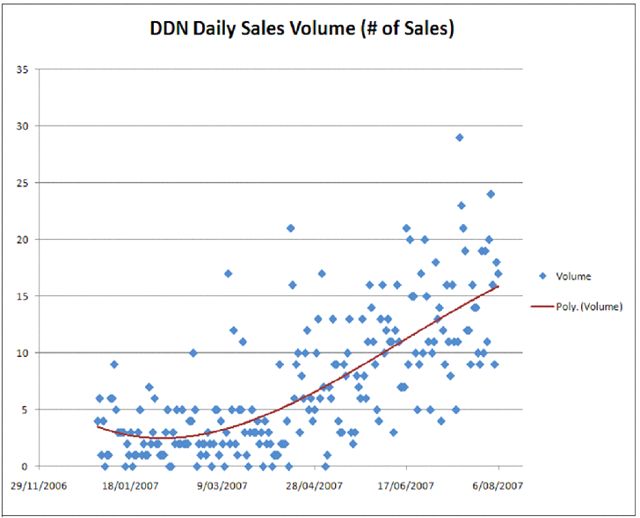

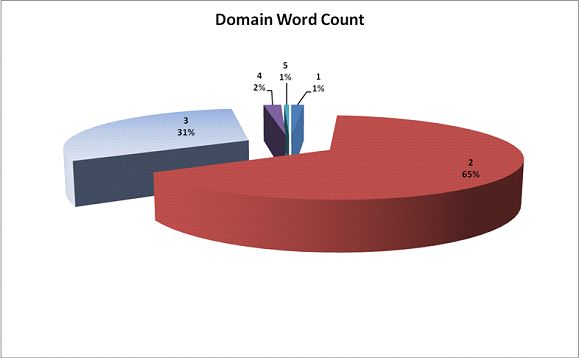

Addendum

- Charts from DDN showing steadily growing sales revenue and

volume:

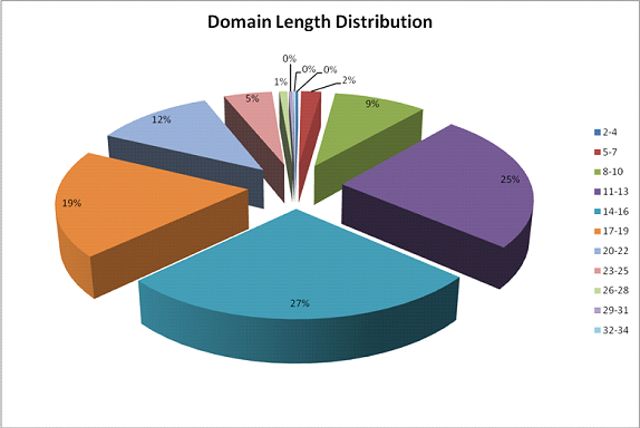

Some Other Interesting

Data from Domain Distribution Network Sales

• 55%

make less than $7 traffic revenue per year

• 36%

three words or more

• 24%

location based domains

• 10%

include a single hyphen

• 18%

have more than 20 characters in length

• 84%

have no heartbeat

• 25%

have no domain phrase search count

• 29%

have no domain phrase bids

• Profitable

domains (more than $7 traffic revenue) sell for > 50 years

traffic revenue

• Domain

Sales generated from 440,000 previously unprofitable domains now

more than cover their holding costs

|