|

Welcome to

our 17th annual State of the Industry

Cover Story! We have once again called on leading experts from all major sectors of the

domain industry to get their take on how the industry

fared over the past year - a year in which a once in a

century pandemic touched almost every aspect of our

lives. While the pandemic is still a long way from

over, we've already learned that, for many, domains

have been one of the business world's safest havens

in the midst of the Covid-19 storm.

We

all hope new vaccines can bring a return to something

close

|

Image

from Bigstock

|

|

to

normalcy by the end 2021 but we also wonder if the

pandemic has created a permanent change in how

people view the importance of being able to do

business in the virtual world? The answer to that

question - also asked of our panel of experts - will

have a huge impact on this industry's prospects in

2021 and beyond. To

assemble our panel we called on successful

domain investors, developers and brokers, as well corporate

leaders from a variety of categories including

registrar and registry operators, aftermarket sales

platforms and conglomerates that offer all of those services

and more. To assure fresh voices are always in the

mix, we aim to have at least half of each year's panel

comprised of members who were not featured the

previous year, and were able to do that again this

year.

|

|

A new wrinkle

this year is a partnership with the NamesCon.Online

conference to expand on the State of the

Industry theme so that we can jointly help

more participants in our dynamic business start

the new year fully up to speed on what changed

in 2020, where we are now and what the future

looks like in this field. As part of that

initiative, when NamesCon.Online 2021

runs January 27-29, I will host a live

State of the Industry session each morning of

the conference. On January 27 I will sit down

with Corporate Leaders, on January 28 it

will be Domain Brokers and on January 29

it will be |

|

Domain Investors

and Developers (those are also the three

categories we sort our panelists into for this

annual article). The NamesCon programs will

include many of the industry experts featured in

this article, as well as some that will be

exclusive to the conference sessions, so I hope

you will take full advantage of both! |

Since we value the

contributions of every expert contributor equally,

we rotate the order that each group appears in every

year. Last year we led with the Domain Investors &

Developers, followed by the Brokers, then the

Corporate Leaders. So this year, the Domain

Brokers move up a notch to kick things

off, followed by the Corporate

Leaders, with the final words going to the

Domain

Investors/Developers (the links in the

preceding category names will take you directly

to those groups). Many of our experts operate in more

than one category. For those multi-talented

individuals, we put them in the group that looks most

relevant for them this year. Now, let's

get this party started with an introduction to the

experts who have graciously taken time out of their

busy schedules to share their insights with you. Please

note: For quick access, we added a LINK

to each expert's photo below. Just click a

photo if you want go to directly to that person's

commentary

(with

one exception - there is no link from my photo at the

bottom right - I

am just

here to direct traffic)!

Personally, I like to read straight through from top to

bottom so I can absorb all of the information from one

complete group at a time, but however you want to

navigate the course, I'm confident you will find it to

be time well spent!

|

|

Our

2021 Panel of Experts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Left

to right):

Row

1: Kate

Buckley (Buckley

Media), Andrew Rosener (MediaOptions.com),

Ryan McKegney (DomainAgents.com), Jeff

Gabriel (SAW.com).

Row 2:

Amanda Waltz

(SAW.com), Mark Daniel (Domain

Holdings), George Hong (Guta.com),

Bill Sweetman (Name Ninja).

Row

3:

Monte Cahn (RightOfTheDot.com),

Jen Sale (Evergreen.com), Michael Robrock

(Sedo), David Warmuz (Trellian/Above.com).

Row

4: Sandeep

Ramchandani (Radix),

Dr. Gregg McNair (Premium Traffic

Ltd.), Mariah Reilly (Donuts),

Andrew Miller (ATM Holdings, Inc.). Row

5: Christa Taylor (DotTBA

and MMX),

Zak Muscovitch (Internet Commerce Association

& The Muscovitch Law Firm), Michael

Castello (Castello Cities Internet Network),

Mike Mann (DomainMarket.com). Row

6: Braden Pollock (LegalBrandMarketing.com),

Deepak Daftari (Tie Kolkata), Morgan

Linton (Bold Metrics Inc. and

MorganLinton.com), Ron Jackson (Editor

and Publisher of DNJournal.com's annual State of the

Industry Report). |

Domain Investors

....and

away we go! Domain

Brokers

Kate

Buckley

Founder & Principal,

Buckley

Media

Seeing

domain name sales brokered by Kate Buckley

at the top of DNJournal.com charts has become a common occurrence

over the as Kate continues to ring up sales of six figures and up

(the most recent being Engage.com at over $800,000

last month). Kate also has a

fascinating life story, one that we detailed in a 2018 DN

Journal Cover Story. Here is Kate's

take on how Covid-19 affected the industry in ways some might

never have expected.

|

Kate

Buckley

Founder & Principal

Buckley Media |

As

news of the pandemic swept the globe, I,

like many in our industry, wondered how it

would affect domain values and

aftermarket sales (both volume and

pricing). I reasoned it could go one

of two ways: a severe pullback and

contraction as marketing budgets shriveled

or were put on ice—or conversely, a

rapid acceleration in demand in alignment

with the old saw: “Out of chaos, comes

opportunity.”

Happily,

the latter proved true, and as businesses

were forced to shift dramatically to

online services in response to the global

pandemic, having a strong and

trustworthy domain name became more

important than ever. After an initial

contraction in startup activity (VC

funding decreased by 20% in Q1), the

second half of the year saw large

increases, both in funding rounds and the

establishment of new startups. This was

particularly pronounced in the U.S., where

an unexpectedly huge amount of new

companies was created in the aftermath of

the crisis (DCMN). Consequently, demand

for consumer-facing premium .coms

skyrocketed. At Buckley Media, we were

inundated on both the buy and the sale

side, and closed out one of our most

successful years-to-date.

|

|

On

significant non-Covid domain industry

trends, the march toward market

consolidation continued (with 2021

promising more of the same). We also saw

some interesting new products and

platforms enter the domain inventory

marketplace (such as DNWE)—which speaks

to the ongoing maturation process of the

still nascent domain name market.

Ideas

previously dismissed as outré are now

being normalized: cannabis, fractional

ownership, etc. The growing global

understanding and adoption of Bitcoin,

crypto, blockchain & distributed

ledgers are changing not only actual

technology, but more importantly for our

domain world, they are underscoring the

global recognition of the cost of not

being agile—left flatfooted with a

rapidly changing global economy and

business ecosystem. In 2021 we’ll see

this further compounded: with the

astounding and massive SolarWinds hack

only recently discovered, executives who

have not invested in security choices

along with IP and shoring up their brand

will pay the price, along with their

companies. All of which opens the door to

continue to educate founders and the

C-Suite on what premium domains bring to

the table!

Wholesale

prices on aftermarket domains continued to

rise as a result of demand—so much so

that some wholesale prices even rose to

lower-end retail level—as the

available inventory of good domain names

(particularly ultra-premium domains)

continues to dwindle, and as more and more

domain investors enter the market. After

all, market uncertainty historically

creates entrepreneurs and emboldens

risk-taking.

Look

ahead to the new year and beyond Kate said

this:

Recession

fears still linger, and companies continue

to recognize and prioritize growing their

status and competitiveness online. Most

investors think the market is either fully

or somewhat in a bubble. To drill down on

this further: a well-known British

investor, Jeremy Grantham, believes that

the stock market is in a

"fully-fledged epic bubble," driven

by extreme overvaluations, explosive price

increases, frenzied issuance, and

"hysterically speculative investor

behavior."

On

that note, there’s a well-noted fear of

inflation on the horizon. Some LPs have

commented that they see early stage

startups as an inflation-protected sector

in which to park their capital. If

they’re correct, that means a lot of

money flooding into startups over the next

12 months. And all of those startups will

need domain names.

Now,

founders seem to grasp, more than in years

past, the need to build their brand on the

bedrock of a premium dotcom. Overall, I

see greater awareness of domain names as

digital assets aided by a field of factors

including: last year’s massive digital

global expansion (compressing years of

growth into one) and greater adoption of

blockchain technology. We can expect to

see new wealth in unpredictable sectors,

along with increasing vocabulary and

acceptance for non-tangible assets like

domain names.

Kate

Buckley speaking at the first NamesCon

Online conference in September 2020,

As

ever, we’ll continue to see growth in

the top 2% of names (ultra-premium .COMs),

with end user sales of one-word, English

Dictionary .coms continuing their rise.

Likewise, good two-word .COM will increase

in both STR and price, due to the scarcity

and price points of the former. On the

other hand, we should see continued

depression in the bottom end of the

market: A polarization—mirroring the

polarization of our economy, and the

sectors that have both thrived in and been

devastated by the pandemic.

It’s

worth watching certain verticals that

experienced accelerated growth due to

COVID. It's these that are bringing in

funding (and thus acquiring domains!) as

they compete to become leaders. Notable

sectors to watch: eCommerce, Gaming,

Digital Media, Healthcare, Crypto, EdTech,

Food, and Biosciences, along with startup

sectors within the categories of: Cloud,

Social, and Delivery.

A

vital note on data collection, biohacking,

and bio tracking (we’ve even normalized

sharing our temperatures everywhere): with

more data, plus the normalization of

sharing more extensive data than ever

before, AI has been empowered to impact

innovation on a whole new level.

This

is a tremendous, world-altering shift,

particularly unexpected after years of

incrementally stringent privacy laws. What

exactly does this new normal of super data

access mean for business? Marco Casalaina,

senior VP of product management at

Salesforce remarked: “The pandemic

introduced countless new digital touch

points for B2C and B2B companies alike,

which means there’s more data than ever

before….IDC predicts that global

spending on AI will double in the next

four years, reaching $110 billion in 2024,

as companies see an opportunity to boost

innovation, improve customer service and

automate routine tasks so their employees

can focus on more strategic work.” And

all of these new digital touch points

translate into solid opportunities for the

domain industry, as these new

companies, products and services require

solid consumer-facing domain names.

Lastly,

these same new touch points and

insights mean better focusing and

targeting, which result in more meaningful

and useful companies/products/services.

And that means more revenue, greater

infusion of capital for startups, and

every single one of those items

means greater need for quality

domains…and more money to spend on these

mission-critical digital assets.

A

final note: the recent focus on a social

media platform’s ability to suspend or

ban accounts (both personal or corporate)

has further amplified how owning one’s

digital brand via a domain name is

mission-critical to ensuring that one’s

voice cannot be silenced. While it’s the

platform’s first amendment right to ban

any user in violation of their policies

(after all, they are profit-seeking

corporations who are well within their

rights to enforce their terms of usage),

it’s definitely opened eyes as to the

consolidated power of social media

platforms (some would say Tech

Monopolies). And, if a company wishes

to ensure they aren’t de-platformed in

the new “public square,” they would do

well to ensure they control their

brand—and therefore, their access to

their audience—via an exact match domain

name.

|

Andrew

Rosener

CEO, MediaOptions.com

At

the 2020 NamesCon Global Conference in Austin,

Texas, MediaOptions.com Founder

Andrew Rosener was named winner of Escrow.com's

#1 broker in the world award, based

on the total dollar value of domains sales

transacted on their platform. Year in and year out

Andrew has proved himself to be one of the very

best in the business.

|

Andrew

Rosener

CEO, MediaOptions.com |

The reality for the MediaOptions business is that we have been a distributed team with no central office since inception in 2008! So

Covid-19 really had no negative impact on our ability to work or our processes in any

way. In fact, because we were ahead of the curve, I suppose it could be argued it provided us with a competitive advantage since we didn’t need to adapt at all. That was reflected in our market share of the domain brokerage market if the numbers from Escrow.com are to be used as a measuring stick.

From a business perspective solely,

2020 was the best year in our company’s history. Overall, what I would say about 2020 was that all of the trends and signals I’ve been picking up on and pondering for the last decade, finally popped their head into reality. 2020 will be seen as

the tipping point where digital real estate began it’s absorption of the bricks and mortar commercial real estate market. When

Marc Andreeseen said, “Software will eat the World.”, this is what he was talking about. EVERYTHING will be digitized, including you! Domain names are and will continue to be the bedrock foundation on which this new digital world is and will be built, likely for decades to come. |

|

2021 is going to be another great year for domain names! However, I do not believe that from an economic, social or even political stand point we will see much “relief” from the Covid blanket. I doubt that vaccines will achieve enough penetration or effectivity to be sufficient for returning the global economy and society to normal, particularly when you consider that this is a global economy today and global society and much of that globe won’t even see a vaccine in 2021. Perhaps towards the end of the year, but my estimate is Spring (Q2) 2022 for any semblance of normalcy.

That being said, the acceleration of the digital trend will continue at an even faster

pace. Healthcare, education, communication, money & even travel will be further digitized. 10 years of adoption and adaptation will be compressed yet again into the next 24 months. Domain names and Bitcoin (perhaps other crypto) will be the biggest winners of that acceleration. 2021 will be the year in which these digital macro themes dove tail, exhibiting entirely new use cases of domain names and DNS, such as: identity, payments, wallets, single-sign-on, geo-targeting, geo-fencing, pseudonymous digital identity, social media, virtual societies (“metaverse”) & digital sovereignty. Combine that with cancel culture and censorship and you have a perfect storm for massive changes of hearts and minds in how the public and business leaders perceive and value domain names (and immutable digital currency). As we witness the greatest transfer of wealth in human history over the next decade, the beneficiaries will be the holders of the strongest, hardest & most recognized digital assets on Earth and the haters and doubters and those that hang on to the legacy economy and society will be the losers of that wealth.

A

blast from the past - Andrew Rosener speaking at

the

2013 Domainfest Global Conference in Santa Monica,

California.

2020 saw a slew of high tech IPO’s that will likely continue into 2021.

The biggest winner there is the venture capital market. Despite what anyone may say, the biggest driver of the domain name market, or better domain name prices, is venture capital. As venture capital goes, so do domain names. There is a flood of liquidity in the VC market and more to come. They have a mandate to reinvest that capital and that means more and bigger funding rounds for startups. From what I can tell, $1 million is the new $100,000 and $1 Billion is the new $1 Million. That means more domain name sales and likely materially higher values as more demand chases less supply of premium domains. Lastly,

.COM will accelerate fastest but as prices increase rapidly, lease options and lease to own models will become the norm as apposed to the outlier and large portfolio owners will begin treating their names more like venture capital than assets to be sold. At the fringe, those who are not smart enough to take advantage of these cash flow advantaged lease models for premium .com domains, will begin adoption of lesser domain extensions. I think .Horse will be the winner in the race for second place! |

Ryan McKegney

CEO, DomainAgents.com

DomainAgents.com

has been making waves ever since the company was

founded by Ryan's brother, Phil McKegney and Adam Strong in

2012. The last three years in a row DomainAgents won

awards presented by Escrow.com as one of the top

ten brokerages in total sales volume worldwide on

the Escrow.com platform.

|

Ryan

McKegney

CEO, DomainAgents.com |

The

pandemic forced ten years of change

into one. Out of necessity,

businesses and services moved online

and consumer habits have been

permanently changed. That rush

online was a boon to domain

registrars and many domain

investors. We had our best

year ever at DomainAgents.

The impact of the pandemic was not

distributed evenly. While many

businesses were hurt immensely,

companies that did well, did very

well. We continued to see a lot of

industry consolidation and record

low interest rates and high stock

prices mean that will almost

certainly continue.

The biggest challenge that we faced

was the one that everyone faced:

uncertainty. In the Spring, as a

business had to suddenly prepare for

the possibility of major economic

disruption. Our employees already

worked from home, but the pandemic

placed an enormous amount of stress

on everyone as we feared for our

health and safety. We've worked hard

to accommodate our employees as

they've dealt with the lockdowns and

stress. Their resilience was a

major contributor to the success

we've had.

|

|

2020

definitely showed us the folly in

making predictions. As I write this

in early January, there is so much

instability and so many unknowns in

politics, vaccine distribution,

crypto, to name just a few areas,

that any predictions for the year

could be proven wrong by next week.

I think many of the long term trends

that the industry has seen have been

accelerated by the pandemic.

More companies and services will

push online, including traditionally

offline services like health and

fitness, and that should be good for

domain prices. Cheap money and

high stock prices will continue to

fuel industry consolidation as

well as interest in domains as

alternative assets.

My advice for the year would be to stay

nimble and open to opportunity.

We're likely at least a year away

from "normal" and what

normal looks like will be different.

In the meantime, stay safe and keep

your eyes open for new

opportunities.

|

Jeff

Gabriel

Co-Founder, SAW.com

Jeff

Gabriel is a world-renowned expert in domain brokerage and

building sales teams. Jeff and Amanda Waltz co-founded Saw.com, a

top tier boutique brokerage that specializes in acquiring,

selling, and appraising domains. Previously, Jeff was the Vice

President of Sales at Uniregistry where he and his team quadrupled

sales dollar volume. Prior to that Jeff was the President and

Co-Founder of Igloo.com and was also a Domain Broker at Sedo. All

told, Jeff has contributed to over $350 million dollars in

completed transactions in this industry.

|

Jeff

Gabriel

Co-Founder, SAW.com |

We officially launched Saw.com

in December of 2019. Our goals are the same now as they were

then:

1. To sell domain names to

every possible type of business in the world at whatever

stage they are their journey; and

2. Have fun doing it.

In Q1 of 2020, we exceeded our

projections in every category. We were, what I like to say,

"Rocking and Rolling." Then mid-March came and

we hit a wall. Buyers who made offers were relieved to

get countered so they were not committed to paying. At the

same time, others in our future pipeline changed from

showing buying signals to, "Call us in a couple of

months." What was a vibrant little startup was becoming

a victim of the virus. There were six of us; we made it a

point to have regular conversations, not just about work,

but about what we were all experiencing. We discussed how we

were feeling and helping each other understand they were not

in this alone.

Once

we were finished asking ourselves where all the toilet paper

went, we decided as a Domain |

|

Brokerage

we weren't going to feel sorry for ourselves and that even

though people were not buying, our customers’ domains

would be at the front of the line when they did. It was

like someone flipping a switch in mid-June. Buyers were

back and we finished the month with just under 1M in sales.

In July, we sold $2,000,000 in domains. In the

remainder of the year, we fully exceeded all expectations,

and December finished with almost $4,000,000 in

domain sales. The virus had a short-term detrimental effect

on our business, but it also has created a demand that I

haven't seen since the Chinese domain market took off in

2015.

When the virus broke out in

March, I recall speaking to a client that works at a large

company with a huge customer service team. That team had

been providing service from different offices throughout the

world. But within a matter of days, they migrated thousands

of employees from those locations to their homes. Use your

imagination. This was no easy feat! Companies that were

lagging technology-wise or getting away with a weak online

presence before COVID learned that they needed to become

more competitive online or take drastic action to stay alive.

That has caused us to see increased demand in the Domain

Brokerage side of the business. On the Domain Blocking

front, clients with established brands and those that are

not household names as of yet are concerned about cybercrime

and want to ensure they are doing everything they can to

protect their business and their customers. |

Amanda

Waltz

Co-Founder, SAW.com

Amanda

Waltz, who co-founded domain brokerage and consulting firm

SAW.com with Jeff Gabriel, is a dedicated and self-motivated

business development professional with over 20 years of internet

sales experience. Amanda is known for her outstanding skills in

business development and communication, as well as her

organizational, conceptualization, and time management skills.

|

Amanda

Waltz

Co-Founder, SAW.com |

The

initial challenges we expected in the early days of the

Covid19 global pandemic being recognized here in the US were

turned into opportunities with the highest annual U.S. ecommerce

growth in at least two decades by the end of 2020.

Opportunities for internet and ecommerce businesses grew

exponentially over the past ten months with ecommerce sales

reaching a staggering $839.02B resulting in a rate of

growth by over 40% from 2019.

Our

clients who recognized this opportunity and pivoted from

physical to online real-estate were able to not only

maintain but scale growth when times were difficult. As a

result, our team has had the pleasure to work with some

incredibly thoughtful founders who have achieved great

success and in turn are giving back to their communities and

customers impacted by Covid19.

For

our team; one of the biggest challenges is finding

inventory for our clients. I believe this trend

will continue as the supply dissipates for |

|

quality

one word .com domains. The prices for short, easy spelled,

meaningfully positive, English language words continues to

increase. One positive trend we see daily is that savvy

marketers finally understand the impact these valuable

domain assets have on their business in the digital

transformation 2020 has brought to our global community.

|

Mark

Daniel

Managing Director, Domain

Holdings Group

Mark

Daniel is a

Digital Real Estate expert who specializes in helping

clients acquire and divest premium domain names and other

online assets. He works with a plethora of individuals,

startups and large brands alike and is widely known for his

dedication to his clients and to the domain industry at large.

|

Mark

Daniel

Managing Director

Domain Holdings Group |

It might be

an understatement to say it’s been an interesting

12 months as we deal with the changes affecting our normal

course of business. When the virus first hit and lockdown

began, many of us in the industry who broker domains had

concerns that it would negatively affect the domain space.

We have found that business has only increased as more

companies shift their focus from “in person” to

“online” and better understand the value of a domain

asset. The online focus and consumer lifestyle changes

during the pandemic created some new markets and many

organizations had to adjust and continue to do so. There are

a plethora of new startups and VC organizations coming to

market. We have seen increased consolidation in the industry

as several companies made large acquisitions in 2020. GDPR

and new privacy laws continue to affect the industry. As

domain name brokers, we have had to further sharpen our

detective skills when trying to track down registrants.

We have also

worked with more new buyers and sellers from all over the

world who have never completed a domain transaction before.

We spend a lot of time educating our clients in our

role as domain name matchmakers. The healthcare |

|

and finance

spaces seemed to be the most active in 2020. Personally, I

miss the face-to-face interactions we have at industry

conferences but am hopeful that someday soon we will return

to meeting in person. I look forward to seeing many of you

at the virtual NamesCon

later this month.

2021

should be a great year for the domain space and

especially for aftermarket domain sales. Domain

valuations will keep going up. I think many of the trends we

saw in 2020 will continue this year. New digital

technologies affect the way we go about our daily lives and

simultaneously, the domain industry is also evolving and

growing. Video services such as Zoom and Teams

will remain vital for interacting with clients, employees

and associates. More online industry events may occur this

year as planning remains difficult due to the pandemic.

Companies are

starting to better understand cryptocurrency and how

to incorporate it into the financial structure of their

organization to ensure they are prepared for the digital

future. We saw this happen with MicroStrategy and I

think as the year goes on, we will see more and more

companies getting involved. As public awareness of the

crypto space evolves, we will see increased crypto-related

domain name sales and more clients wanting to buy and sell

using cryptocurrency.

In 2020,

about 98% of our transactions were with retail end-user

buyers vs. wholesale buyers. As domain prices increase,

that trend will likely continue. We will keep helping our

clients make the best decisions on the right domain. Many

clients are trying to differentiate themselves from their

competitors by using short, memorable .com names. Premium

domain name sales are increasing, and it is important for

all of us to keep an eye on the changing global market

conditions. Prices for super-premium category killer domains

will continue to appreciate as we see more and more domains

“off the market forever.” Here is to a healthy and happy

2021! |

George

Hong

Founder & CEO, Guta.com

George

Hong, a native of China who spent years

living in

the U.S and maintains offices in both

countries, is intimately familiar with key buyers

and investors on both sides of the Pacific. When

Chinese buyers became a major force in the domain

aftermarket - especially at the high end of it - a

few years ago, George's brokerage company, Guta.com,

was experienced tremendous growth that catapulted

the firm into the top tier of brokerage services.

|

George

Hong

Founder & CEO

Guta.com |

In 2020, businesses

adapted to the pandemic by moving online.

However, online companies faced challenges

too. An example: many Asia based gambling

or sports betting websites were out of

business. These websites typically prefer

numeric domains; their struggle is one of

the reasons that total short numeric

domain sales fell to a historic low since

2018 (According to Guta's Premium

Domain Sales Observation Report).

Due to global

trade wars and government monetary policy

controls, in 2020, it was much more

challenging than in prior years for the

Chinese buyers to convert CNY to USD and

wire the money overseas. Compared to

prior years, the number of investor buyers

who sought our help to buy domains

decreased, while the number of end-user

buyers, who sought our help, increased.

We see more

and more Chinese domain investors

buying/selling premium one-word .com

domains from/to overseas. The quantity of

western individuals and end-users

entrusting Guta to purchase domain names

from China has been increasing.

|

|

The pandemic

has accelerated many trends. Some of them,

such as the work from home and shop

from home trends, will not reverse in 2021.

More companies will allow employees to

work from home permanently. For

many businesses, the quality of their

domain names is more important than their

office locations.

Global

central banks had “printed”

extraordinary amounts of fiat money in

2020 and will continue to do so in 2021.

The Fed’s massive injection of fiat

money will cause hyperinflation. Buying

premium domain names is a smart way to

protect against inflation.

Bitcoin has

been setting record highs in the first two

weeks of 2021 after it blew past its

previous high of $20,000 at the end of

2020. Bitcoin and Crypto Market will

Boom in 2021. A robust cryptocurrency

market means good things for the domain

industry, as crypto companies and

investors flush with extra cash as their

cryptos rise are more likely to buy domain

names. Furthermore, there are advantages

of cryptocurrency payments over fiat money

payments.

Guta has

successfully brokered premium domain

transactions paid via cryptocurrencies. I

believe that increased cryptocurrency

payment adoption among domain name buyers

and sellers will lead to more domain name

transactions. I expect domain sales in

2021 would be very active, and we will see

a lot more high price domain sales

reported than we did in 2020. |

Bill

Sweetman

President & Lead Ninja, NameNinja.com

Bill

Sweetman has been an internet

professional for well over 20 years with

experience in just about all aspects of the

industry. With numerous six-figure sales under his

belt, Bill's skill set

has made Name Ninja one of the top domain

brokerages/consultancies in the business. He is

also a top tie conference moderator as you will see again at NamesCon.online

January 27-29, 2021.

|

Bill

Sweetman

President & Lead Ninja

Name Ninja |

In

February and March, due to the

pandemic and general business mood

at the time, Name Ninja proactively

went into defensive mode and 'braced

for impact'. I've managed

several businesses successfully

through global economic recessions

in the past, so I knew the general

playbook to use, although I was

still on edge since this time things

felt very different. We were fully

expecting a downturn in our buyer

brokerage business, especially after

one mid-sized project was cancelled,

so we took evasive action, watched

our expenses and cash flow very

closely, and secured additional

business lines of credit so we could

ride out the storm. We also tried to

shower our loyal clients with lots

of love and attention for sticking

with us.

Miraculously,

that storm never came, and we

saw a steady uptick in business from

April onwards. We ended up having

the second best year in the

seven-year history of Name Ninja,

and I partially credit that to the global

awakening that companies the

world over had that doing business

means doing that business online

via a Website using a great

quality domain name.

I

also give major kudos to my amazing

team of Ninja and freelance agents

who were already used to

|

|

working

remotely and really pitched in to

help one another through a very

challenging time. I know that many

businesses suffered or collapsed

last year, it was painful to see

that devastation, so I feel very blessed

to work in that rare business sector

that actually saw business increase

this past year. 2020 was a brutal

year that really tested everyone's

patience and strength and also

forced us to focus on what's

important in life. I feel very lucky

to have survived the year,

personally and professionally.

2021

is shaping up to be a huge year in

the domain industry. The economy is

going to improve, especially in some

countries, and more and more

businesses have realized the

importance of using a great domain

name. With innovative platforms like

DAN.com and DNWE.com and others

making bold moves in this space,

2021 is going to be an exciting year

of change, disruption, and new

opportunities the likes of which we

haven't seen in over a decade. Here

at Name Ninja, we're onboarding an

additional Ninja to our team this

month, and I'm no longer bracing for

impact, I'm bracing for growth! |

Monte

Cahn

Founder, President & Director, RightOfTheDot.com

Monte

Cahn is a true domain

industry pioneer who has handled some of the biggest domain sales

on record while providing world class aftermarket services since entering

the industry (before it was even an industry) back in 1994. Monte

deserves a lot of the credit for paving the way countless other

have followed over the past 25 years.

|

Monte

Cahn

Founder, President & Director

RightOfTheDot.com |

The Covid / Corona Pandemic significantly affected the entire world and therefore

I would say everyone was negatively affected in some way. Although only a few did not see or feel it in the domain industry, I would say the majority of the market was down by at least 30% in overall sales volume and possibly more in sale value averages due to the overall financial markets being down globally. People were holding onto their funds, some industries like entertainment, travel, restaurants took and are still taking huge negative hits so if you have domains in those industries, you saw a significant drop in traffic, revenue, and sales and resale values.

On the other side, healthcare, telemedicine / covid, work at home, etc. related domains increased in value, however, sales volumes certainly were not increased that much due to the uncertainty in overall markets and the unpredictable events happening around us.

To that end domain names proved once again to be a very valuable asset in bad

times. Although values in many categories saw some lows, there was still some liquidity and many saw good chances to buy at good prices while others sold for profit and reallocated those funds for other

purposes. It |

|

reminded me of flashbacks of the 2000 and 2008 recessions where domain names were a quantifiable asset that could be turned into cash or a new venture. I / RightOfTheDot managed to sell several big 6 figure domains in March through August and a 7 figure name along with others before year end. Those names could have sold for more given the right environment and circumstances but everyone was happy on all sides.

The process of getting back to normal will take time in my opinion. My guess is that it will take 18 - 24 months for things to settle down and come back to somewhat normal especially with the political changes and turmoil in our government. In the mean time the stock market has been gaining strength as well as crypto currency markets. With that said, many are losing their jobs as business continue to close and we will likely have the highest unemployment rates and downward pressure on the overall economy in years. This is likely to affect most financial markets and will affect the domain industry.

In my opinion, it is more important than ever before to keep our industry fluid with legitimate sales and transactions. To have domain names highlighted and at the top of industries as live successful businesses will be critical. To that end and in full support of our industry, I / RightOfTheDot will hold yet another successful premium live and online auction in February with details to be announced soon! Domain sales are good for our business and this industry, in good times and in bad. It proves that domain names are real assets with residual value and those domains can continue to trade, become real companies and businesses and information sites, etc. In some cases, the sales prices may not be that in years past but

having transaction liquidity and fluidity will be very important over the next 2

years. This will keep our industry strong and eventually thriving once again. |

Jen

Sale

CEO, Evergreen.com

Veteran

domain broker Jen

Sale has been consistently producing

results for buyers and sellers for nearly 20

years now. She has extraordinary expertise in

confidentially buying, leasing and selling

high-end domain names for start-ups, major brands,

investors and public figures, worldwide. Jen has

also founded tech startups Sparkly.com and

Trash.com.

|

Jen

Sale

CEO, Evergreen.com |

Throughout

2020, Evergreen.com

experienced a surge in sale enquiries for one-word

.COM domain names under brokerage.

Some

of our prospective buyers included aspiring entrepreneurs

seeking great domains for their new ventures,

brick-and-mortar businesses going digital and established

companies expanding virtually and upgrading their brands.

A number of leads were not familiar with the domain name

aftermarket and valuations, so our team spent time with

them, breaking it all down. As such, we have considerably

expanded our buyer network for one-word .COM domains.

One-word

.COM domains will continue to increase in value and

demand, however the quality of leads may be questionable

for some time - something we are personally working to

remedy via our sale

landers and marketplace.

The

future of professional travel looks grim

in |

|

the

midst of COVID-19, so video teleconferencing and virtual

events are not going anywhere, anytime soon. We highly value

and enjoy in-person meetings with colleagues, clients and

friends, and can’t wait for a face-to-face reunion! |

|

Next

up....

Corporate

Leaders

Michael

Robrock

CEO, Sedo.com

After

a successful 20-year career in online marketing, Michael

Robrock took on a major role at Sedo in

August 2019 as their new Chief Operating Officer.

Barely a year later, on Sept.

1, 2020, Robrock was picked to lead

the company as the industry giant's new CEO.

|

Michael

Robrock

CEO,

Sedo.com |

2020

was a year like no other that no one

could have prepared for but in spite

of all its challenges, Sedo had one

of its best years performance-wise.

Like many others in our industry,

there was a small negative impact

when the pandemic first began but

we came back from this vigorously. We

saw internet usage expand

correlating with an increased demand

for domains, our parking

business grew expotentially and

domain trading overall peaked well

above our predications especially at

the ultra-premium level. There was

also a 20% uptick in our

ccTLD sales category which

may be due to businesses targeting

specific markets internationally.

For

us personally, we take the safety

and comfort level of our employees

very seriously and in response to

the global pandemic, Sedo

immediately transitioned to working

remotely from home. Our staff

was well prepared for this shift as

home office is already in practice

within our corporate culture. But

naturally we are looking forward to

when we can safely be all together

again in our offices.

Overall,

our challenges in the last year

dealt mostly |

|

with

adapting to the “new normal”

but even under these unusual

circumstances Sedo was still working

towards improving and further

developing our existing product

lineup and services. Another

challenge we’re addressing is

being able to offer an even more

efficient and streamlined selling

process to our domain sellers. These

are just a few goals we will

continue to work on in the coming

year to achieve some very

positive results.

Everyone

including all of us at Sedo are

anxiously awaiting a broad and

successful distribution of the

Covid-19 vaccines resulting in more

normalcy in their daily lives. With

this we still see the need further

increased for businesses to have effective

online presences and be able to

support their customer bases fully

online which means more domain

sales for marketplaces like

ours. With financial markets

moving towards more balance, there

will also be more investments in

premium domains and increased

activity from domain investors more

willing to take risks in building up

their domain portfolios.

AI

and technology are still going

to be big areas of opportunity

within the domain world. As will bitcoin

and alternative currencies. Themes

that have come from the pandemic

like virtualization including online

learning, remote working options and

delivery services will continue to

perform strongly among domain sales.

As people start to return to their

normal ways of life and getting out

more fashion, cosmetics

and similar categories will have an

increase in sales along with related

domains. Travel and leisure

industries should also experience a

positive spike after a huge hit to

their business lines.

The

domain industry has undergone a lot

of consolidation in recent

years and with all the shifts of the

past year, it’s only natural to

foresee this continuing. But

we believe overall the industry will

become stronger and more resilient

even with all of the changes we’ve

faced in the last year. |

David

Warmuz

Founder & CEO, Trellian.com

and Above.com

Trellian.com

Founder David Warmuz celebrated the company's 23nd

anniversary in 2020. David, who serves as CEO of both

Trellian its popular domain monetization, aftermarket and

brokerage platform, Above.com, launched Trellian

with his late brother Ren and their remarkable journey was

detailed in a November 2017 DNJournal Cover

Story.

|

David

Warmuz

Founder

& CEO

Trellian/ Above.com |

As

for 2020, what a year it was!

I

know that 2020 was a difficult year for

everyone, with lots of changes required,

not just at work, but also how we work, at

home and with family. These changes

forced us to adapt and we were

fortunate enough to be in an industry that

saw substantial increases in demand.

We were also extremely blessed to have

such an amazing team of over 60 that had

to transition to working from home. The

whole team grew closer and many work flow

improvements were made that I know our

business will benefit for many years to

come.

As for the domain industry, domain

monetization and domain name sales

were a clear winner, in both volumes

and $ values. More and more businesses

realized the need to go online and the

need for a good domain name, thus creating

a demand that is still strong. This

trend will continue in 2021, so

definitely expect more sales and for more

$.

The demand for quality traffic in many

verticals had a huge spike in 2020,

with some exceptions such as travel

vertical that dropped to nil. Good news is

that we are starting to see signs of

recovery in

|

|

the

travel vertical as well, but 2021 will see

a continued growth in demand for domain

traffic by many advertisers. Domain

traffic simply converts the best.

Many

clients saw a greater need for a

professional service to help them manage

all parts of their portfolios:

registrations, renewals, sales and

monetization. Our focus for 2021 will be

to continue to grow our Above Managed

domain portfolio service that generated

exceptional returns for our clients,

capitalizing on our strong advertiser

demand , that we fully anticipate to

continue to growth.

As predicted, Bitcoins in December

2020 started their usual upward trend, but

where it peaked even surprised me as one

of the original miners and investors. I

really liked this surprise!

2021 will see a number of bitcoin price

corrections and multiple runs that I

expect to surpass the current top price.

Really looking forward to 2021 and

consolidating on the amazing growth and yes

we are hiring! |

|

|

|

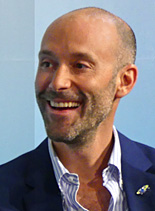

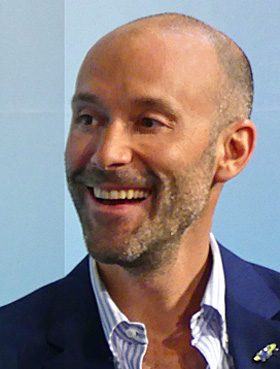

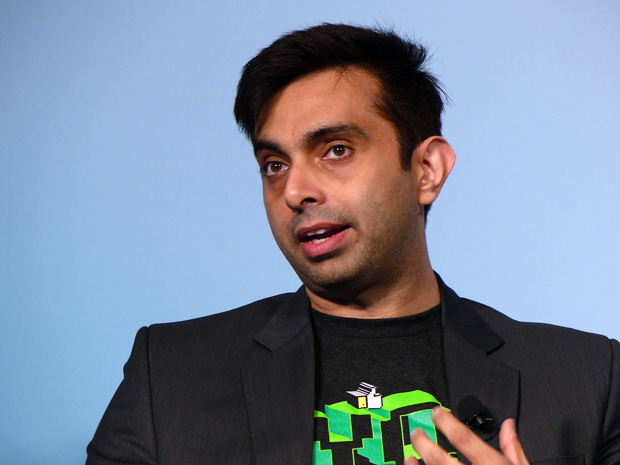

Sandeep Ramchandani

CEO, Radix (part of the Directi Group)

In

2018 Sandeep Ramchandani

completed a 15-year rise through the ranks to

become CEO

at Radix Registry, a

position he continues to thrive in at a company

that operates nine new gTLDs and one re-purposed

ccTLD as part of industry giant Directi Group.

Radix now has millions of domains under

management.

|

Sandeep

Ramchandani

CEO, Radix Registry |

Covid

related challenges

When

Covid hit, it filled our minds with a

type of uncertainty we had not experienced

before. We resisted the advice to lower

our marketing investments, and to brace for

an extremely challenging few years ahead as

the global economy slips into recession.

Every economic pundit was certain that Covid

is the trigger which would end the

economic boom that we had witnessed in

the previous decade. Knowing that the growth

in our business is correlated to the

economic activity in general and birth-rate

of new businesses more specifically, we did

expect some short term detrimental impact

which would last a couple of years at least.

I

recollect a particular weekend in March when

I received some enquiries from our founders

regarding Covid’s impact on new sales. My

response was "Nothing yet! As a

matter of fact, we've just had our best

weekend in 2020!" I expected that

to be an aberration and that we would

eventually start seeing a slow-down. I

couldn’t be more wrong; as was evident in

the months that followed.

|

|

Turned

out that domain names, along with all

sorts of digital products and services,

would see a sharp boost followed by

a sustainable acceleration in growth

due to Covid. As cities started locking

down, businesses of all types, and retail

in particular, could no longer put

'building a website' on the backburner.

Websites were suddenly elevated to

becoming mission critical for every

business, whether small or large, and

across industries globally.

.store

and .online for obvious reasons

have seen the most uptake since March, but

all other TLDs including .site, .fun

and .tech have had one of their

best years yet.

Major Non-Covid

Event

Registry

Industry

One doesn't

need to look back too far, or think too

hard, to identify the Afilias sale

to Donuts as the biggest event

in Registry space last year. Afilias has

been one of the most recognizable brands

in our industry, and it played a big part

in the development of the modern domains

ecosystem. They also contributed to the ICANN

community by setting new technical

benchmarks, innovating in the DNS, and

combating abuse. As someone who entered

the industry at the time when .info was

launched, for me, this marked the end of

an era.

Domains

Industry

The biggest,

and easily the most shocking, event (or

non-event) of the year was ICANN

rejecting .org's sale to a private equity

group, Ethos Capital. I was amongst

those who assumed that ICANN's approval

was a mere formality. ICANN's board must

be given due credit for making the bold

decision. There is a clear alignment

between PIR's 'not for profit' status, and

the purpose behind a vast majority of the

.org registrants. Moving .org to a

'for-profit' private equity entity under

the stated terms, and placing .org under a

$360 million debt, would not

be in any way serving the best interest of

the 10 million+ .org user base. It

enables ICANN to signal to the community

at large that they are more than a 'rubber

stamper', and that it can do what's

necessary to uphold the interest of

internet users at large.

Radix

CEO Sandeep Ramchandani speaking at

the

2018 NamesCon Global conference in Las

Vegas.

We

see Covid as an accelerant.

Large segments of customers sitting on the

sidelines, not seeing it as necessary to

set up a business website or adding

e-commerce capabilities to their existing

websites, now see their online presence as

one of the ways to ensure survival in the

post-Covid world.

Even after a majority of the world's

population is vaccinated, and things start

returning to normalcy, the way of doing

business will be changed permanently.

Having gone through a phase where

digitization and virtuality was forced,

those who operated in a 'high-touch',

analog style, have tasted the gains in

efficiency by adopting a virtual-first

approach of doing business. And there's

no going back!

Carvana, a platform where

used-cars are purchased online, did $1.5

billion in revenue in Q3 2020 (up

43% yoy). How quickly has mankind gone

from questioning the idea of buying

everyday items on the Internet, to

trusting a 100% online experience for

buying a car? Cars are usually among the

top three highest ticket purchases made by

any household. Carvana buyers have no

opportunity for a prior, real-life visual

of the vehicle, leave aside taking it for

a quick spin to see how it 'feels'.

If the ultimate, high touch, high

ticket and high experience product can

shift to online first, anything can,

and over time, everything will.

Radix operates a bunch of great top

level domains such as .online, .site,

.fun, .tech, store amongst others. We feel

extremely good about playing a more

dominant role in powering the online

addresses of the new generation

entrepreneurs across industries.

Extremely excited over what's in

(.)store in 2021. As more of the world

moves (.)online and (.)websites gain more

prominence, it's going to be a busy but

(.)fun ride ;) |

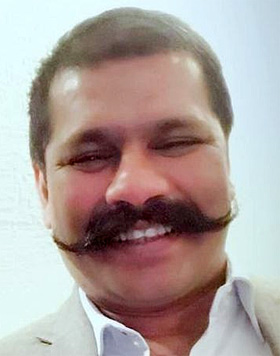

Dr.

Gregg McNair

Founder and Chairman, Premium

Traffic Ltd.

Dr.

Gregg McNair is a veteran of our industry despite, as he would

say, being somewhat late to the party! The background and

commercial skills of ggg, along with his technical management

team, quickly advanced PTL to a position of prominence and success

which has been maintained for more than 15 years.

|

Gregg

McNair

Founder & Chairman

Premium Traffic Ltd. |

Whilst

2020 began with the normal flurry, and Namescon in Austin

set the tone for a great year, we all know that the Pandemic

quickly impacted the whole world, including our industry,

mostly in negative ways at first. But as the world became

more accustomed to the new normal, so our ever flexible

industry morphed to embrace the before unknown intensity of online

communication, business and shopping.

The PTL

monetisation platforms ended the year with amazing upward

results, more than compensating for the devastation of a

few specific verticals, such as travel and entertainment.

The

harvesting of new domains has become one of our major

businesses these days with monthly revenues exceeding

seven figures in December and on track for much more. The

business model of accumulation and excellent monetisation

has stood our group in good stead for continued expansion

and servicing of new larger monetisation clients.

One

wonders where the consolidation of our space will end,

however in such a comparatively small industry many of the

combinations actually make sense overall. |

|

Philanthropy

has always been an intrinsic cornerstone of the PTL Group.

The year 2020 brought a whole new level of needs and

opportunities to provide assistance to hundreds of

families devastated by Covid and the subsequent

lock-downs of already impoverished communities.

All in

all, a pretty terrible year for the world but not so bad for

the domain industry.

Sharing the view that the 2021

recovery of world economies, post Covid, will take much

longer than predicted, we remain confident that internet

use, fueled somewhat by more permanent work from home

adoption, will continue to grow.

I believe that the Covid

vaccination programs will experience slippage and setbacks,

especially in poorer countries and the pandemic will

continue to prevent the rapid return of many of the old

freedoms we enjoyed.

Consolidation will

continue fueled by at least two factors. Economics will

force some industry players to sell, especially those which

have dependencies outside of domain sales or monetisation.

Uncertainties and the reflection on life values, encouraged

by the pandemic, will bring others to change focus and

decide to liquidate even if valuations are less than

previously envisaged.

The impact of Verisign price

increases will negatively impact the whole industry in

2021 and will test the resolve of that company, the only

positive recipient, to retain any respect in the industry by

deferring once again the .com price increases. Almost

everyone knows that despite the injustice of the increases

from any perspective, that ICANN failed to protect

its constituents once again.

Dr.

Gregg McNair urging attendees at the 2016 NamesCon

Global conference in Las Vegas to join and

support the Internet Commerce Association - the

non-profit organization dedicated to protecting domain

owner's rights.

There are other potential

injustices facing domain registrants in 2021. Our only

collective voice, especially at ICANN, is the Internet

Commerce Association (ICA). Join

the ICA or increase your membership category to

enable our registrant rights to be better protected from

those seeking to dilute or destroy them. Contact Kamila

on +1 646 894 4590 or kamila@internet

commerce.org

I'd like to acknowledge and thank

those who have joined us in assisting the less fortunate in

this world as they experience the further body blow from

Covid. It's far from over for them and we are redoubling our

efforts for 2021 in gratitude for the comparative and

unique prosperity our industry has, and continues to enjoy.

Contact me for further details +1 512698 0407 or [email protected]" |

Mariah

Reilly

Senior Director, Channel Management, Donuts

Inc.

Mariah

Reilly is a talented domain industry veteran who has been

serving in executive positions with top tier domain companies

since entering the business back in 2007 with Demand Media.

Successive stints with eNom and Rightside led to her current

position with Donuts, the world's biggest operator of new TLDs

with well over 200 extensions in their portfolio.

|

Mariah

Reilly

Senior Director, Channel Management

Donuts Inc. |

Everyone has been affected by

the events of 2020 in different ways. I am incredibly proud

of not just Donuts’ resilience and agility during the

uncertainty of the past year, but of our industry as a

whole. Kudos to all the people who quarantined and

working remote still ensured that businesses were able to

thrive and grow online!

At Donuts, we have a bird’s

eye view of the industry and domain trends. We’ve observed

the pandemics' effect on the world reflected in our data as

almost every industry pivoted to virtual or alternative

operations. Trends such as telehealth, virtual or hybrid

education, delivery services, fitness, streaming and more

were all reflected in TLD sale trends during 2020. TLDs such

as .delivery, .live, .boutique and .education

saw surges up to 300% YoY.

Seeing

these trends in real time gave the Donuts team a renewed

appreciation for the strength of the TLDs in our portfolio.

It also influenced enhancements we made to Donuts products

like RNS, to help users find the best available name for

their digital identity. The data we are seeing also inspired

a new publication from Donuts called the Domain

Trend Reports... a fun report to share |

|

the

domain trends we see with the rest of our industry. Despite

the abnormal circumstances and adjustments that everyone on

our team had to make, Donuts came out of 2020 stronger

than ever.

Digital security was and

is at the forefront of everyone’s mind! Not only did we

get this feedback from consumer surveys we conducted in

early 2020, we saw those concerns mount as the Internet

experienced a surge in the number of malicious behaviour

and cyber attacks during the height of Covid-19.

Protecting against phishing and other security

vulnerabilities is an increasing priority for businesses of

all sizes. Providing a secure internet will

continue to remain in the forefront of Donuts’ mission.

In 2020, we launched the TrueName brand, offering

registrants the benefit of our robust security technology by

blocking malicious homographic domain variants on every

Donuts domain registered at no cost. Our commitment to

security will continue as we integrate Afilias teams

and technologies. I predict that we will see more

companies and individuals within the domain industry become

more vocal and take action to provide a secure and safe

place on the internet in 2021. |

Andrew

Miller

Founder & President, ATM

Holdings, Inc.

When

you talk about longevity in the domain world a lot of people have

been around long enough now to be called veterans but there aren't

too many real pioneers - people who who were successfully

plying the trade in the 1990s - over 20 years ago now! Andrew

Miller is one of the pioneers and he has the track record to

prove it.

|

Andrew

Miller

Founder & President

ATM Holdings, Inc. |

I have been investing in

domains since 1998, when we acquired our first category

domain, Beer*com, which we sold a few months later

for an eye opening $7.2m at the time. From there, I

went on to be a Founder, investor, partner, or advisor on so

many "iconic" category domains, such as Diamond*com,

Shop*com, Timeshares*com, Computer*com,

Software.com, Chocolate.com, Tours.com,

and of course my operating companies, CreditCards*com

& InsuranceQuotes*com.

While 2020 with Covid had such

a widespread impact on how businesses both thrive and

survive, it was also a transcendent year for a shift

in category and exact match domain names. While from

1998-2019 we experienced the success of several generic

domain name branded companies, as well as large dollar

buy/sell transactions, 2020 was the year where it became

evident that the decades of education of the importance

and asset value of prime Internet addresses really bore

fruit. Many of the most successful emerging PE and VC

backed companies realized that their exact match category

domain name was both a must have asset and a path of

least resistance to widespread word of mouth growth,

increased sales, and exponential enterprise value.

|

|

The

next step is to see this trend expand to the corporate and

investment fund management teams that still have not

figured this out. It is a next level time for domains,

with so much opportunity, provided we can keep the momentum

to overcome some of the same challenges that have existed

since 1998. 2020 was the most important shift

towards that of any year to date.

2021

has to be a better year for our country and the global

landscape. While Covid will not resolve itself for awhile,

making 2021 as challenging at the outset as 2020 was, there

is so much to look forward to and be optimistic about.

The vaccine will begin to take hold, likely halfway through

2021. We have new leadership in the US that, regardless of

one’s political affiliation, will bring more positivity,

compassion, and collaboration to the globe, which is good

for both humanity and business. Many people, small

businesses, companies, and industries will have been gravely

hurt by the pandemic, and many others will have thrived

because of the new normal. In either scenario, resiliency

and adaptation will be a necessary trait. The year 2020

was transformative in how business in all categories will be

conducted for decades to come, and in many ways accelerated

changes and facilitated behaviors that were already

underway. It will continue to be necessary to adapt quickly

and embrace seismic shifts. Partial remote to fully

remote work is here forever, cloud kitchens will be a

mandatory skill set for those in food service, home fitness

will grow, and a cashless society led by Bitcoin type

crypto currencies will become mainstream.

What

does this mean for domain names? They will continue to

be the “landing spot” and “doorway” to all of these

shifts and great opportunities. “Location, location,

location” will be more important than ever on the global

Internet. Secondary TLD’s will continue to bolster

the asset value of .com and be a money maker for

registrars and secondary marketplaces, yet a poor investment

by those who buy them, as .com becomes as

engrained in the mind of billions of consumers as the word

that comes before it. The convergence of all devices that

was promised in the early 2000’s is finally real and

it’s here, and domain names are the common link, a trend

we will see continue from 2020 and be cemented in 2021.

|

Christa

Taylor

Founder, DotTBA

& Chief Marketing Officer, MMX

Christa

Taylor is another one of those rare executives who has now

spent over 20 years in the domain business and unlike almost

anyone else you will meet, Christa started in this business

at the top - as the CEO/CFO at Poker.com Inc. in 1999! In

2012, Christa, a master of analytics, founded DotTBA - a

firm that provides financial, marketing and other services to new

generic Top Level Domains and

in 2019 she took on an additional role as CMO at MMX. You

will also see a lot of Christa at NamesCon.Online

where she will be one of the primary moderators.

|

Christa

Taylor

Founder, DotTBA and CMO, MMX

|

From a

data perspective, the wave of COVID related domain name

registrations was both interesting and concerning. In

January there were around 1.3k names registered containing

‘covid’ or ‘corona’ to a peak of 64k in March to

6.9k in December for a yearly total of 205k. Data was

used to flag websites disseminating disinformation and

unsafe products (fraudulent cures, uncertified personal

protective equipment, fake test kits, spoof government

financial aid sites along with the familiar cyberthreats) to

help keep people safe.

Also, a time

where analytics became a part of everyone’s daily

routine. News outlets provided timely updates on

infection rates using machine learning from data collected

around the world on a daily basis (yes, daily!), a host of

now mainstream terms, ‘flattening the curve’,

‘infection rate’, ‘next wave’ and the use of visual,

interactive graphs and maps have become the norm.

Both

a challenge and an opportunity is the development of

streamlined methods and |

|

policies

that support registrars and registries in safeguarding

users from disinformation that could affect the health

and safety of users. At the same time, non-EU

governments will be wrangling on introducing new

legislation on internet privacy, akin to GDPR, which

could generate a multitude of new issues within the Internet

community.

On the positive side, we’ll

become accustomed to new visual charts on the volume of

vaccinations and predictions on when herd immunity targets

will be achieved and when we’ll be able to see our friends

and colleagues in person instead of a video call. |

Zak

Muscovitch

General

Counsel at Internet

Commerce Association & Principal at The Muscovitch

Law Firm

Veteran

Toronto-based attorney Zak Muscovitch has

long been acknowledged for his expertise in

UDRP issues but he has also gained acclaim for

the extraordinary work he has done as General Counsel for the Internet

Commerce Association (the non-profit

organization that protects to domain registrant

rights). While Covid-19 overshadowed almost every

aspect of business and personal life around the globe, Zak pointed

out that some events of historic importance to domain registrants

also went down in 2020.

|

Zak

Muscovitch

ICA General Counsel &

Principal at The Muscovitch Law Firm |

In

my capacity as General Counsel to

the Internet Commerce Association (ICA),

I would say that one of the most

significant events from 2020 was

the rejection of the attempted

acquisition of the .Org registry by

Ethos Capital for 1.3 Billion

dollars. In 2019, ICANN removed all

price caps on .org domain names despite

massive public opposition. The

historical price caps were a crucial

safeguard against unjustified price

increases on a captive market of

.org registrants. By removing price

caps, ICANN paved the way for the

attempted purchase of the entire

.Org registry by Ethos Capital, who

obviously determined that

unrestrained price increases on a

captive market made the .Org

registry an even more lucrative

take-over target. Some people

believed that the fact that the .Org

registry was in the hands of a not

for profit, Public Interest

Registry, was a sufficient guard

against unbridled price increases on

registrants, so when the purported

Ethos Capital acquisition was

announced, many people immediately

realized that .Org registrants were

likely to be subjected to

unrestrained price increases by the

new for profit owner.

The

harm of the impending price

increases were compounded by the

fact that many .Org

|

|

registrants

are non-profit organizations

such that cost increases would come

at the expense of the services that

they are providing, who are long

entrenched on .org domain names,

have no suitable alternatives, and

in any event migration to another

TLD would be impractical for many

and would cause confusion and make

them more vulnerable to fraudulent

impostors.

Since

ICANN had already demonstrated

disregard for the public interest in

removing price caps in the first

place, many were fearful that ICANN

would do the same thing again, and

permit Ethos to take over the .Org

registry. One of those fearful

parties was the California Attorney

General Xavier Becerra, who

on April 15, 2020, wrote to ICANN

and urged ICANN to reject the

transfer and let ICANN know that it

would take “whatever action

necessary” to protect registrants.

This unprecedented intervention by a

powerful governmental authority on

ICANN’s normally independent

decision-making demonstrated that ICANN

was not trusted to make decisions in

the public interest, having

disregarded it in removing price

caps in the first place, thereby

setting the table for the purported

acquisition. ICANN, under threat

from the California Attorney

General, was then compelled to

reject the acquisition.

ICANN

has a history of deferring to the

large companies under its mandate

and approving sweetheart deals

that benefit those companies at

the expense of the general public

whose interests ICANN is supposed to

represent. It is unfortunate

that it took outside action by the

California AG's office to prevent

this debacle. We will only

learn in the future whether the

significance of ICANN's rejection of

the sale of .org to Ethos Capital is

that ICANN is unable to protect the

interests of the general public on

its own, or whether the significance

is that this is a wake-up call

alerting ICANN to its failure and

that ICANN will now remember for

whose interests it is supposed to be

acting. The significance of

the event is also that ICANN

was on notice that governmental

authorities are prepared to

intervene in the public interest

when ICANN fails to do so.

ICA

General Counsel Zak Muscovitch

speaking at a meeting of Internet

Commerce

Association members at the 2020

NamesCon Global conference in

Austin, Texas.

In

terms of how Covid affected ICANN,

well it cancelled all in-person

meetings for the foreseeable future.

Such meetings, which have

historically been conducted in

far-flung places 3-4 times a year

have always been subject to

criticism due to their expense and

utility. So the cancelling due to

Covid in some way, was arguably

an improvement since it has been

demonstrated that much of ICANN’s

work can be effectively conducted

online.

2021

will see how the new Administration

in Washington may affect .com

pricing. Under the Trump

Administration, ICANN and Verisign

were permitted to raise prices on

.com registrations despite no

real justification for doing so.

It is of course yet to be seen how

new leadership at the NTIA,

Department of Commerce, and

Department of Justice views ICANN

and its virtually perpetual no-bid

contracts with registry service

providers, but there is an

expectation that improvements are